The oil and gas industry is not doing nearly enough to meet Transition targets, says the IEA. Only 1% is invested in non-core activities. That needs to rise to 15% within 10 years. The IEA’s article summarises their comprehensive report “The Oil and Gas Industry in Energy Transitions”, released this month. It explains how the industry’s existing skills and “deep pockets” make them ideally placed to invest in low-carbon fuels (Hydrogen, … [Read more...]

“Climate leader” UK: why did low-carbon electricity generation stall in 2019?

In 2019, just 1TWh of low-carbon electricity (wind, solar, nuclear, hydro, biomass) was added in the UK. That’s after a decade of adding an average of 9TWh/year. Why? The UK needs to know, given an extra 15TWh/year is required until 2030 to meet emissions goals on top of the planned electrification of transport and heating. Carbon Brief’s Simon Evans runs through their thorough analysis. Wind power alone rose by 8TWh in 2019, but was offset by … [Read more...]

The Six Energy Paradoxes that slow the sector’s progress

Gerard Reid at Alexa Capital takes a high level look at what he sees as six systemic problems faced throughout the energy sector. They can be found at every level, across all technologies and markets. He calls them the Six Energy Paradoxes. All of them are acting as a serious drag on progress, Transition or not. Take the Market Efficiency Paradox. Utilities should adjust their prices to meet changes in energy supply and demand. Higher supply or … [Read more...]

Gas infrastructure leaks methane: fix it, or accelerate to clean energy

Natural gas, because it’s low-carbon, is being used as a bridge fuel away from the old fossil fuel world. But there are two main problems. The infrastructure leaks methane (the main component of the gas) which is 25 times more potent than CO2 over a 100-year period (and 86 times over a 20-year period!). And, crucially, nobody is properly measuring those leaks. That means policy makers are growing the gas mix without knowing by how much it’s … [Read more...]

Hydrogen’s future: reducing costs, finding markets

Although 100Mt/year of hydrogen is produced globally and at scale, it’s overwhelmingly for the chemical industry. So there’s a long way to go for it to play a role in the energy transition. It’s not even clear whether hydrogen will be best used directly as a power source or through further conversion into other powerfuels. That's why Dolf Gielen and Emanuele Taibi at IRENA are scoping out the challenges of reducing production costs and finding … [Read more...]

Fossil fuel politics is changing: Big Oil, automakers split on Trump lowering standards

Cara Daggett at Virginia Tech has noticed a positive change in corporate support for the Transition. In the past, Big Oil and automakers would have opposed any limits to business-as-usual. But today, major oil companies, including BP and Royal Dutch Shell, are opposing U.S. President Trump’s intention to further deregulate methane emissions. That’s because they’ve invested heavily in natural gas as a bridge fuel for a clean future, which would … [Read more...]

An independent Global Energy Forecast to 2050 v the IEA’s WEO 2019

Schalk Cloete has completed his own 5-part independent Global Energy Forecast to 2050 to compare with this year’s IEA World Energy Outlook, published mid-November. Underpinning all his predictions is his bet that the world will adopt tech-neutral policies (i.e. not backing any one technology over another, like a very high carbon tax) in 2030: in his opinion it will be the best way to accelerate the transition to meet the Paris goals as the 1.5°C … [Read more...]

Why renewables need gas: case study USA

Everyone is predicting the continued expansion of gas through to 2050. Jim Conca reviews the state of play in the U.S. to explain why that projection makes sense. The welcome and rapid growth of renewables still needs something to provide backup load-following to a growing and increasingly intermittent electric grid. Gas is the cheapest to roll out and can keep prices low for decades. The other two contenders, hydro and nuclear, just can’t match … [Read more...]

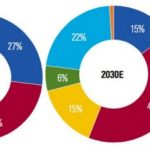

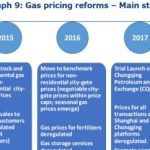

The rapid liberalisation of China’s domestic gas market

China’s coal-to-gas ambitions are driving big changes to its internal gas markets, says a report “China’s Quest for Blue Skies: The Astonishing Transformation of the Domestic Gas Market” by the IFRI Centre for Energy & Climate, authored by Sylvie Cornot-Gandolphe. To cope with a doubling of gas demand by 2030, market reforms are liberalising the downstream gas market. Nobody wants a repeat of the winter shortages of 2017-18. And air … [Read more...]

An independent Global Energy Forecast to 2050 (part 3 of 5): fossil fuels

Schalk Cloete is creating his own 5-part independent Global Energy Forecast to 2050, to compare with the next IEA World Energy Outlook, due in November. To make his predictions he has created simulations of cost-optimal technology mixes and made his own assumptions over the drivers that will affect them: policy, technology, demand growth and behavioural change are all included. Cloete reminds us that fossil fuels did not reach their dominant … [Read more...]

Hydrogen Fuel Cell trucks can decarbonise heavy transport

Patrick Molloy at Rocky Mountain Institute runs through the pros and cons of hydrogen fuel cell vehicles (FCEVs). The big pluses are that hydrogen has an energy density of around 120 MJ/kg, almost three times more than diesel or gasoline. Half the energy generated by an internal combustion engine is wasted as heat, whereas electric drivetrains used by FCEVs only lose 10%. Nikola Motors, a U.S. maker of hydrogen trucks, claims its vehicles can get … [Read more...]

TurkStream disruption: Turkey, Greece can become new gas hubs

For over 30 years the Trans-Balkan pipeline has been used to pump Russian gas to southeast Europe. But Russia’s construction of the new TurkStream pipelines can open the door for the Trans-Balkan to be re-purposed, explains Aura Sabadus writing for the Atlantic Council. Going forward, LNG can be imported into Turkey and Greece and pumped back up the same pipes to serve the region, reducing dependence on Russian gas. However, such a plan would … [Read more...]

Extract CO2 from our air, use it to create synthetic fuels

Carbon Capture needs to take off, but nobody knows how it’s going to happen. We need innovation, scrutinised, tested and funded. Jim Conca looks at a method of extracting CO2 directly from the air that’s being pioneered by Carbon Engineering in Canada, backed by private investors and government agencies. It grew out of academic work at the University of Calgary and Carnegie Mellon University. It’s “Direct Air Capture” system can remove a ton of … [Read more...]

Calculating the effect of $50/tonne CO2 on energy prices

Despite much debate, governments are hesitant to raise – or even impose – carbon pricing, worried about the direct impact it will have on businesses and consumers.To help understand its effect Severin Borenstein at the Energy Institute at Haas has crunched the numbers of a $50/tonne CO2 price, very expensive by today’s standards. He’s calculated the actual price increases on a gallon of petrol/gasoline, gas- and coal-fired generation, and natural … [Read more...]

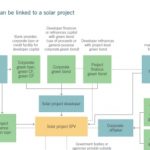

Private finance must invest in carbon asset retirement, not just clean energy

The Climate Finance Leadership Initiative (CFLI) is laying out concrete plans for the private sector to finance the low-carbon transition, say Tyeler Matsuo and Lucy Kessler of Rocky Mountain Institute. One important insight of their new report “Financing the Low-Carbon Future” is that it’s not enough to back clean energy. Climate finance also needs to accelerate the retirement and transformation of the carbon assets that are responsible for 78% … [Read more...]

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- 19

- Next Page »