BlackRock’s decision to divest from coal, as the world's largest asset manager with a long shareholder history of voting against climate action, sends a powerful signal. By mid-2020 BlackRock’s $1.8tn of actively managed funds will divest from any firm generating more than 25% of revenue from thermal coal. Further reviews of sectors heavily reliant on thermal coal will also take place. Tim Buckley, Tom Sanzillo and Melissa Brown at IEEFA welcome … [Read more...]

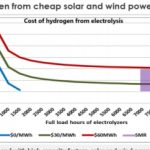

The Clean Hydrogen revolution: how, by whom, when?

Hydrogen rivals oil and gas for storage and hard-to-decarbonise sectors (industry, heavy and long distance transport). But it isn’t all carbon free. “Grey” hydrogen – the cheapest at €1.50/kilo - is made from gas. “Blue” hydrogen depends on the fortunes of carbon capture technology. “Green” hydrogen is CO2 free, but needs further cost reductions in the green electricity used in the electrolysis process. Noé van Hulst, at the Netherland’s Ministry … [Read more...]

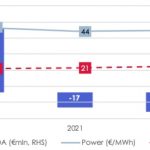

IEEFA Germany: RWE’s coal phaseout compensation demands defy market prices

How much should the coal producers be compensated for Germany’s phaseout? RWE wants €1.2bn per GW at least, basing its maths on an EU-approved scheme from 2015. But Gerard Wynn, writing for IEEFA, says too much has changed since then, not least the Paris Agreement and the actual market price for coal assets. By his calculations, the true price should be under €100m per GW down to near zero. Vattenfall and Engie have already taken such a hit. … [Read more...]

Opposition to Nord Stream 2 ignores market fundamentals [Energy Post Weekly]

Criticism of the Nord Stream 2 project routinely misses the bigger picture of EU’s lower carbon targets, Groningen’s impending switch-off and Russia’s own dependence on natural gas exports to Europe. … [Read more...]