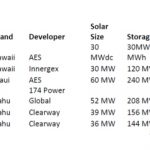

A report by IEEFA looks at trends in the U.S. to install utility scale batteries. The report’s author, Dennis Wamsted, gives examples of how it is replacing the peaking and seasonal generation being provided by gas and coal. Emissions aside, the numbers are starting to add up. In Hawaii the combination of solar generation and storage is expected to undercut the price for fossil fuel generation. In Texas, Vistra Energy’s batteries are soaking up … [Read more...]

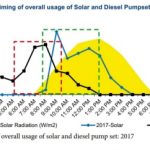

Can India’s 30m grid/diesel irrigation pumps go solar?

The Indian government is looking for effective ways to increase the use of solar powered pumps for small farm irrigation. About 70% of India’s rural households still depend primarily on agriculture for their livelihood, and successful farming usually requires irrigation. Currently, 21m pumps are connected to a primarily fossil fuel grid and 8.8m are diesel while solar has risen to just 130,000, mostly added in the last 5 years. Lelin Thouthang … [Read more...]

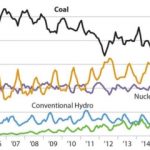

U.S. Coal: firms go bankrupt as share of generation halves over 10 years

In the U.S. coal’s market share for power generation has halved in 10 years to 24%, from close to 50% in 2008. That year a record 1,172m tons was produced. But a combination of the rapid drop in solar and wind costs, continued competition from cheap gas, and ageing coal plants (most were built between 1965 and 1985) means that steep decline is set to continue, say Seth Feaster and Karl Cates of IEEFA U.S.. It’s why Cloud Peak Energy, the … [Read more...]

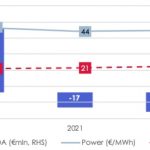

IEEFA Germany: RWE’s coal phaseout compensation demands defy market prices

How much should the coal producers be compensated for Germany’s phaseout? RWE wants €1.2bn per GW at least, basing its maths on an EU-approved scheme from 2015. But Gerard Wynn, writing for IEEFA, says too much has changed since then, not least the Paris Agreement and the actual market price for coal assets. By his calculations, the true price should be under €100m per GW down to near zero. Vattenfall and Engie have already taken such a hit. … [Read more...]

Low oil price alongside rise in renewables sees Oil & Gas slide to bottom of S&P 500

In December we reported that in 2018, the U.S. became the world's leading oil producer for the first time since the 1970s. It is tipped to produce 12 million barrels of oil per day this year (up approximately 10% year on year), and over two-thirds of it will come from shale producers. But the consequent squeeze on the oil price meant U.S. Oil & Gas firms ended the second year in a row at the bottom of the stock market. IEEFA’s director of … [Read more...]