To reach the Paris Agreement target of limiting global warming to 1.5°C, the world needs to triple renewable power capacity by 2030. Here, the IEA summarises its report “COP28 Tripling Renewable Capacity Pledge: Tracking countries’ ambitions and identifying policies to bridge the gap”. The report looks at almost 150 Nationally Determined Contributions (NDCs) which set out each country’s plans, and also looks at actual progress (which in many … [Read more...]

At $2tn, investment in Clean Energy in 2024 is set to be double that for Fossil Fuels

A new report by the IEA reveals that global spending on clean energy technologies and infrastructure is on track to hit $2tn in 2024, driven largely by attractive cost reductions, improving supply chains, energy security, and government policies. This is despite higher financing costs for new projects. The combined investment in renewable power and grids only recently overtook the amount spent on fossil fuels, in 2023. 2024 will see it at double … [Read more...]

Financing Hydrogen projects in Emerging Markets and Developing Countries

Financing the new hydrogen economy is already a challenge. Financing hydrogen production in Emerging Markets and Developing Countries (EMDC) is an even bigger one, yet vitally important for supplying richer nations with hydrogen while creating new industries in the EMDC. This month, the World Bank Energy Sector Management Assistance Program (ESMAP) together with the Government of the Netherlands and Invest International organised a Financing … [Read more...]

Low Emission Hydrogen: creating markets to get buyers to make firm commitments

Low emission hydrogen is expected to play an important role in global decarbonisation, though costs today are very high and must come down. Economies of scale will help, but production is yet to pick up pace as there are inadequate ‘demand signals’ which result in financial risks for project developers. Kapil Narula and Luciano Caratori of Climate Champions Team, Laurent Antoni at IPHE, and Nigel Topping (former UN Climate Change High-Level … [Read more...]

Hydrogen: most nations’ plans to export to Europe don’t match reality. The EU should make it itself

The EU’s RePowerEU plan, quickly made in response to Russia’s invasion of Ukraine, aims to produce 20m tonnes of renewable hydrogen by 2030, with half coming from imports. Here, T&E summarise their report that concludes this is unrealistic. The report looks at six key countries with plans to export hydrogen to the EU: Norway, Chile, Egypt, Morocco, Namibia and Oman. T&E says these countries combined would only be able to deliver a quarter … [Read more...]

Massive global expansion of Renewables coming. But we’re still short 20% of our 2030 target

The IEA has released the 143-page “Renewables 2023”, the latest edition of its annual report on the sector. The world added 50% more renewable capacity in 2023 than in 2022 and the next 5 years will see fastest growth yet. Under current policies and market conditions, global renewable capacity is already on course to increase by two-and-a-half times by 2030: great news but still short of the tripling we need. A key reason for the gap is the lack … [Read more...]

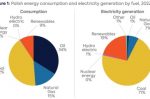

Poland’s Coal-to-Nuclear plans move forward with U.S. partners

Poland sees nuclear as ideal for replacing its coal, explain Matt Bowen and Sagatom Saha at the Center on Global Energy Policy. Though Poland's renewables like wind and solar have grown rapidly in the last few years, reactors can provide dispatchable heat and power in the way that coal currently does. Poland is extremely reliant on coal, generating over 70% of its electricity and giving it the second-largest coal fleet in the EU. Hence, in … [Read more...]

New Solar study: 50% of global power by 2050, even without more ambitious climate policies

Nadia Ameli at UCL and Femke Nijsse and Jean-Francois Mercure at the University of Exeter present their study that shows solar is on track to make up more than half of global electricity generation by 2050, even without more ambitious climate policies. This far exceeds any previous estimates: last year’s IEA World Energy Outlook predicted that solar would account for only 25% by 2050. The authors’ macroeconomic model takes the latest … [Read more...]

China’s Belt and Road Initiative is now building more Renewables, less Coal

Energy has always made up the majority of investments and construction deals signed through China’s Belt and Road Initiative (BRI). Until very recently these investments were dominated by fossil fuel projects. But in the first half of this year, over 40% of BRI energy projects announced were wind and solar, with 22% each for gas and oil, and zero for coal projects. The reasons include China’s stated commitment to clean energy, avoiding the risk … [Read more...]

H2 Green Steel has raised billions in 3 years: a case study of Industrial Project Finance

The financing of H2 Green Steel (H2GS), founded in 2020, can be taken as a template for capital intensive industrial first-of-a-kind projects that must raise billions quickly to build from scratch and go live. Shravan Bhat and Asia Salazar at RMI describe H2GS’s financing journey to reveal five key lessons for raising funds. Against the usual logic, large, diverse, equity investor pools can work (H2GS counts over 20 different equity investors). … [Read more...]

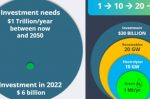

Financing Renewable Hydrogen globally: ramp up to 2030 only needs $150bn/year

Dolf Gielen, Priyank Lathwal and Silvia Carolina Lopez Rocha at the World Bank present a thorough review of the pathway to financing global clean renewable hydrogen over the coming decades. The wind and solar that powers production will continue to get cheaper, and so will electrolyser costs as they scale up. Nevertheless, the total financing will still be considerable. World Bank analysis shows around $30tn between now and 2050 will be needed … [Read more...]

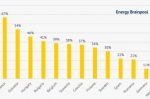

EU Taxonomy: why nations are backing Nuclear and Gas

The heated debates over the potential inclusion of nuclear power and natural gas in the EU taxonomy has again exposed the different interests of EU nations. Simon Göss at cr.hub, writing for Energy Brainpool, explains what parameters the EU taxonomy controls, what conditions are attached should the two technologies be classified as sustainable, as well as summarising those national interests and constraints. Critics say neither should be … [Read more...]

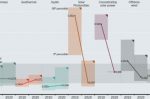

Wind, Solar: continuing cost declines will help meet rising renewables targets

The EC’s “Fit for 55” proposals include the raising of the EU’s 2030 target for total energy produced from renewable sources to 40%. Much of the rest of the world will likely raise its targets at some point too. Continuing to cut the cost of renewable energy generation will be essential to make that happen, and take pressure off all the other associated costs of supporting its integration into the energy system. Michael Taylor at IRENA summarises … [Read more...]

Financial incentives for Grid Modernisation: the problem with guaranteed returns on investment

Grid modernisation is going to be very expensive. What’s the best way to pay for it? The financial incentives governments put in place now will determine what investments get made, how cost-effectively it’s done, and who ultimately pays. Meredith Fowlie at UC Berkeley’s Energy Institute at Haas explains that a common method is for a government to give some sort of guaranteed return on investment for the new asset. But it’s far from ideal. … [Read more...]

Buildings Efficiency in China, and what EU partners should know

To set up our upcoming online event (April 13th & 14th) "China: Carbon Neutral by 2060 -EFFICIENCY FIRST” we look at how Buildings Efficiency is being tackled by Energy Management Contracting (EMC), when an ESCO (energy service company) provides energy retrofit services and gets paid for the future energy savings. The up-front investment cost is recouped over the multi-year lifetime of the service contract by taking a cut of the genuine … [Read more...]

- 1

- 2

- 3

- …

- 38

- Next Page »