Taxing carbon at the border is a lot more complicated than you may think, explains James Bushnell at the Energy Institute at Haas. The EU’s Carbon Border Adjustment Mechanism (CBAM) imposes a tax on imported goods that is designed to reflect the carbon content of those goods. But CBAM has flaws that must be addressed. It taxes the carbon in imported inputs supplied to EU producers, but not the carbon of those same inputs if they are imported as … [Read more...]

Message to environmentalists and the left: you can’t oppose both fossil investments and Carbon Pricing

Environmental and social justice opponents of fossil investments need to think carefully about the consequences of preventing all forms of new fossil infrastructure and maintenance. As Catherine Wolfram at the Haas School of Business explains, if fossils are phased out faster than clean energy is phased in, consumer prices go up and the fossil firms profit. A carbon price – often opposed by the same U.S. “progressives” as a tax disproportionately … [Read more...]

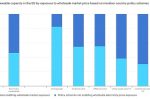

How to tax renewable energy firms for windfall profits from high wholesale electricity prices

Should windfall taxes be imposed on renewable energy firms that have benefitted from the current high electricity prices caused by the increases in oil, gas and coal prices triggered by Russia’s invasion of Ukraine? If so, how, and how much? The IEA has conducted a study of the EU to try to uncover who has (and hasn’t) made extraordinary profits, and how much. Up front they say this is difficult to do as the majority of installed renewable … [Read more...]

What is Energy Security? And what it isn’t

What is energy security? That’s what Maximilian Auffhammer at the Energy Institute at Haas asks and tries to answer, and he starts by saying what it is not and what solutions should not be used. Not importing won’t help because prices are global. “Energy security” can’t be taxed as an externality for much the same reason. Subsidising high prices for consumers decreases the value of energy efficiency investments. Instead, Auffhammer says the … [Read more...]

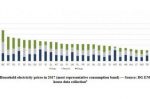

What do German households pay for power? Costs, surcharges, taxes, grid fees

Power prices in Germany are among the highest in Europe. Though the high costs are in large part due to the mandatory support for renewable energy sources, most customers continue to support the country's energy transition. That might be because German households only pay a little over 9% of their average monthly income on energy, similar to France and the Netherlands. In contrast, Bulgarian households spend more than 25% percent on electricity, … [Read more...]

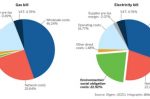

Redesigning UK electricity taxes to boost Heat Pump sales

In the UK, consumer prices for electricity are five times more expensive than for gas. It is a disincentive to adopt electric heat pumps. To make things harder, 23% of the electricity price comes from climate and social levies. It’s just 2% for gas. No wonder the UK continues to install about 1.7 million gas boilers a year. Jan Rosenow and Richard Lowes at RAP call for changes that will incentivise customers to buy heat pumps while having a … [Read more...]

Financial incentives for Grid Modernisation: the problem with guaranteed returns on investment

Grid modernisation is going to be very expensive. What’s the best way to pay for it? The financial incentives governments put in place now will determine what investments get made, how cost-effectively it’s done, and who ultimately pays. Meredith Fowlie at UC Berkeley’s Energy Institute at Haas explains that a common method is for a government to give some sort of guaranteed return on investment for the new asset. But it’s far from ideal. … [Read more...]

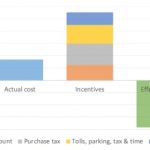

Norway an EV role model? Their pathway is expensive and paid for with oil & gas exports

Norway is an EV leader thanks to a generous pot of tax incentives. Today, battery-electric cars make up more than half of all new car sales in Norway. Schalk Cloete takes a detailed look at what those incentives cost, and how many tonnes of CO2 they avoid. In short, Norway – a major oil and gas exporter - needs to sell over 100 barrels of oil (which emits 40 tonnes of CO2) to pay for the tax breaks it gives EVs to avoid one tonne of CO2. And … [Read more...]

A carbon tax on car fuel? A fossil car phase-out date is more effective

The EC is working on a carbon tax on car drivers as part of its big climate plan review in June. William Todts at T&E warns that the EC shouldn’t make the same mistake French President Macron made back in 2018 when severe gilets jaunes protests against a fuel price hike made him back down. A very high carbon price, decided by the market, may have the same effect, getting us nowhere. Instead, Todts gives his three point plan. The carbon tax … [Read more...]

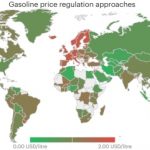

Low gasoline prices create a window for tax changes to fund energy transitions

Low crude oil and gasoline prices create an opportunity for all governments to reform the way they tax or subsidise these important fuels. In general, richer importing nations have high gasoline taxes to generate substantial revenues. Poorer nations subsidise them to cut the bill for their citizens and industries. Oil producing nations do little of either. Domenico Lattanzio and Alexandre Bizeul at the IEA explain how nations that use subsidies … [Read more...]

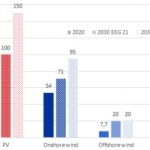

Germany’s Renewable Energy Act 2021: how to implement the fine policy detail of emissions reduction targets

After much haggling and debate, Germany’s Renewable Energy Act (EEG) 2021 was finally approved in December and came into force on 1 January 2021. Sila Akat and Simon Göss at Energy Brainpool outline the most important changes imposed by the amendment. It gives an insight into how a nation is dealing with the finer details of increasingly ambitious emissions reduction targets. The authors cover the main issues and outcomes. How Germany is dealing … [Read more...]

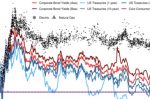

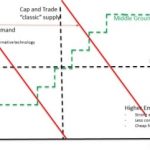

California learns even flexible Emissions Markets won’t guarantee price stability

In May, emissions allowance prices hit rock bottom in California. How can cap-and-trade work properly when prices are so volatile and difficult to predict? It makes life very difficult for businesses and investors, not to mention the state. Changes to the rules are being proposed to introduce more flexibility into the effective price floors, ceilings and the availability of allowances. But Severin Borenstein at the Energy Institute at Haas … [Read more...]

How much subsidy do EVs need to be competitive?

Despite a wide range of subsidies and incentives, battery electric vehicles (BEV) make up only 1.4% of new car sales in the U.S. That the effective battery cost is zero to the consumer doesn’t seem to be lifting that number any higher. Meanwhile, in Norway the percentage is a much more impressive 42%, but those subsidies and incentives are far higher: the effective battery cost is negative 385 $/kWh for a typical 60kWh battery pack, i.e. a very … [Read more...]

Aviation’s multiple challenges: from renewable fuels to non-CO2 emissions

Barely the first steps towards climate-neutral aviation have been made. High energy density renewable fuels are needed, and at scale. But even as they become available, hard-to-abate industries will be queuing up to buy them first. And then there’s reducing the "non-CO2 effects" that, according to Germany's environment agency (UBA), can harm the climate twice as much as direct CO2 emissions: condensation trails, particles and other greenhouse … [Read more...]

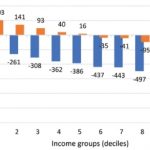

Rising green taxes: making them acceptable to all

Environmental taxes hurt low-income households the most because they spend a much higher proportion of their income on heating oil, natural gas, and electricity. It’s why Spain has low green taxes, far below the EU average. Mark Dwortzan at MIT explains how researchers from the U.S., Germany and Spain teamed up to show that low-income households can benefit from environmental taxes provided those tax revenues are carefully redistributed in their … [Read more...]