The new EU Emissions Trading System, ETS 2, covers emissions from buildings, road transport, and additional sectors such as fuel use in small industrial installations. It’s designed to reduce emissions by 42% by 2030 compared to 2005 levels. Florian Schlennert, Simon Göss and Hendrik Schuldt at carboneer describe how it works, and what firms must do to comply. Comprehensive monitoring, reporting, and verification (MRV) must be implemented at the … [Read more...]

EU ETS: what happens when rising Carbon Prices start to hurt low income groups?

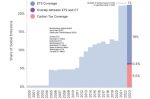

The main purpose of the EU Emissions Trading System (EU ETS) is to put a price on emissions and generate revenues from companies buying allowances for creating those emissions. Right now energy, manufacturing and aviation are covered. From 2027, maritime transport will be added to the existing EU ETS, while buildings and road transport will be regulated in the upcoming ETS2. From then, nearly 80% of total EU emissions will be under the ETS and … [Read more...]

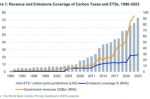

Carbon Pricing annual receipts are almost $100bn globally and rising

About one-quarter of global emissions are, to varying degrees, covered by carbon pricing schemes. They’ve raised over $500bn from polluters to date. Andrew Reid at NorthStone Advisers, writing for IEEFA, summarises his report which says the annual amount raised, now almost $100bn, is set to increase with two-thirds of nations planning to use carbon pricing in their Nationally Defined Contributions. And the EU’s Carbon Border Adjustment Mechanism … [Read more...]

Green Steelmakers’ global future: importing the Iron from where Renewables are cheap, the Ore abundant

Governments in Europe have allocated around €5bn to 10 commercial-scale hydrogen-ready DRI (direct reduced iron) facilities for steelmaking, but even with these generous subsidies steelmakers are struggling to reach final investment decisions, citing high costs for domestic hydrogen as a barrier. And when you consider that over €400bn is needed to transition the entire European sector to hydrogen-based steelmaking, a totally new way of thinking … [Read more...]

Why isn’t Methane included in the EU’s Carbon Border Adjustment Mechanism?

Robert Kleinberg at CGEP explains why methane isn’t included in the EU’s Carbon Border Adjustment Mechanism (CBAM) which imposes a carbon tax on imported goods. Basically, CO2 emissions are easy to estimate accurately, whereas methane emissions are not. Many methane emissions, even the largest ones, are intermittent and of highly variable duration. Gas leaks vary over many orders of magnitude, and once diffused in the atmosphere leave no local … [Read more...]

How can Biomass fulfil its potential in EU carbon markets?

In carbon markets such as the EU ETS participants must monitor and report their emissions and ultimately pay for them. Biomass occupies a unique place. It is well positioned to be a net-zero emissions energy source for hard-to-abate sectors. Coupled with effective on-site carbon capture technologies, it can be carbon negative. And there is a great diversity of project types involving forestry, biochar kilns, waste-to-energy, carbon capture and … [Read more...]

EU Carbon Prices halved in a year. But they should rise again

European carbon allowances (EUAs) are trading at around €60/t. One year ago, it was at an all-time high of €100/t. Hæge Fjellheim at Veyt explains why, and why prices should recover. Economically, the drop is due to two main factors: lower gas prices and shrinking energy demand from industry. Politically, additional supply of EUAs came from the EU’s REPowerEU plan to accelerate the energy transition and break dependency on Russian gas by partly … [Read more...]

EU ETS or national climate targets? We need both

The choice between using the EU ETS or national climate targets to decarbonise is a false dilemma. We need both, explains Chiara Corradi at T&E writing for the Florence School of Regulation. There are plenty of examples where a carbon market and national targets have delivered good results together, as in Germany, Finland, Denmark and Portugal. And, looking ahead over the next few decades, the right policies should be able to cope with ETS … [Read more...]

U.S. and EU: vastly different approaches to trade and climate put a transatlantic deal at risk

Uncertainty over the results of this year’s elections in the U.S. and the EU have effectively postponed trade deals between the two blocks. That means when talks restart in 2025 there will be even less time to find the best compromises. As Gautam Jain, Noah Kaufman, Chris Bataille and Sagatom Saha at the Center on Global Energy Policy explain, it’s why this time should be taken to better understand the differences and lay out the possible … [Read more...]

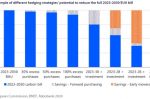

Buying carbon allowances while decarbonising: what’s the best strategy for an EU industrial firm?

EU industrial companies affected by the big changes to their carbon costs that come from the new EU ETS rules and the Carbon Border Adjustment Mechanism (CBAM) must create strategies to deal with them, if they haven’t started already. Otherwise they will fall behind those that have. Pablo Ruiz at Rabobank summarises their analyses and conclusions. Ruiz presents a map for each of the different starting positions. The study looks at the critical … [Read more...]

Why we need a European Central Carbon Bank within the EU ETS framework

The EU Emissions Trading System (EU ETS) is at a critical juncture as it navigates a path towards achieving a net-zero Europe by 2050. Amidst this transformation, the proposal to create the European Central Carbon Bank (ECCB) has sparked a range of criticisms. Some critics have raised valid concerns about the feasibility, necessity, governance, and potential drawbacks of such an institution. Robert Jeszke and Sebastian Lizak at the Centre for … [Read more...]

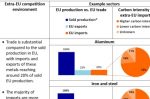

How much protection from carbon-intensive imports will CBAM give to EU industries?

The EU’s Carbon Border Adjustment Mechanism (CBAM) is not a business-as-usual instrument that allows sectors to delay decarbonisation. It applies a levy on imported goods equal to the internal EU ETS-related carbon price, so that both EU-produced goods and those imported into the EU face similar carbon cost pressures. But sectors must use the CBAM phase-in period to decarbonise. Pablo Ruiz and Barbara Kölbl at Rabobank look at how different … [Read more...]

CBAM is now active. A guide to what companies must do to comply

On October 1st 2023 the Carbon Border Adjustment Mechanism (CBAM) became effective. Its purpose is to limit carbon leakage by establishing a carbon price on imported goods that is equivalent to the carbon price on domestically produced goods. That means introducing a set of reporting and compliance obligations for importers of goods into the EU. Simon Göss and Hendrik Schuldt at carboneer explain the new mechanism and scope (aluminium, cement, … [Read more...]

Carbon Pricing: almost 25% of emissions now covered globally, but coverage and prices must rise further

Despite early scepticism, carbon pricing is making its mark globally. Today almost a quarter of global greenhouse gas (GHG) emissions are covered by a carbon price, compared to just 7% ten years ago. 73 national and sub-national jurisdictions have carbon pricing, explain Joseph Pryor and Venkat Ramana Putti at The World Bank, writing for the Florence School of Regulation and quoting from the World Bank’s State and Trends of Carbon Pricing 2023 … [Read more...]

Understanding the new EU ETS (Part 2): Buildings, Road Transport, Fuels. And how the revenues will be spent

A fortnight ago we published Simon Göss’s explainer of the big changes happening to the EU’s Emissions Trading Scheme (ETS). That article covered the new rules coming in for the existing EU ETS, and the implementation of the new carbon border adjustment mechanism (CBAM). This article explains the introduction of an EU ETS II that extends emissions trading to the buildings sector, road transport and the usage of fuels in other, as of now not … [Read more...]