The EU Emissions Trading System (EU ETS) is at a critical juncture as it navigates a path towards achieving a net-zero Europe by 2050. Amidst this transformation, the proposal to create the European Central Carbon Bank (ECCB) has sparked a range of criticisms. Some critics have raised valid concerns about the feasibility, necessity, governance, and potential drawbacks of such an institution. Robert Jeszke and Sebastian Lizak at the Centre for … [Read more...]

“Options to Reform the EU ETS”: coping with price volatility and speculation (event summary)

Sara Stefanini provides a written summary of our panel discussion held on 31st March 2022, “Options to Reform the EU ETS”. It’s a full summary of the 90 minute discussion (with a link to the video), but it begins conveniently with a summary of the highlights, leading with the role of financial players, who they are, the causes of price volatility, what reforms can create stability, and the cost of decarbonisation. The main concern is speculation … [Read more...]

The EU’s “Fit for 55” package: a primer on the EU ETS and other main policy levers

On July 14 the European Commission will present the much awaited “Fit for 55” legislative package. Lara Dombrowski and Simon Göss at Energy Brainpool have written a very useful primer on what’s at stake for the EU ETS, along with a summary of the other main policy levers that will be decided upon. The authors describe the EU ETS as the central instrument for reducing greenhouse gas emissions. It caps emissions for 10,000 power sector, industrial … [Read more...]

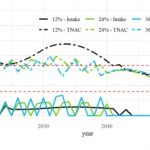

EU ETS: The Market Stability Reserve should focus on carbon prices, not allowance volumes

The Market Stability Reserve (MSR) aims at providing carbon price stability for the EU Emissions Trading Scheme (EU ETS). But serious questions are being asked about how much stability – if any – it provides, say Michael Pahle at the Potsdam Institute for Climate Impact Research and Simon Quemin at the LSE's Grantham Research Institute. They argue that the MSR rules are too complex, have difficulty accommodating changing EU and national policies, … [Read more...]

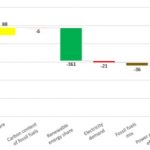

Re-shaping the EU ETS as a safety net, not a driver

The EU ETS (Emissions Trading System) has struggled to cope with the current economic crisis which has caused a drop in the European carbon price, while the expected drastic drop in 2020 emissions will only add to the existing surplus of allowances. This highlights how necessary it is to reform the mechanism for managing this surplus or even to implement a carbon floor price, explain Charlotte Vailles at I4CE and Nicolas Berghmans at IDDRI. They … [Read more...]