Donald Trump has always backed oil and gas, and U.S. industry giants donated $7.3m to his campaign, three times more than for his 2020 run. Joe Biden has introduced green energy policies and other transition legislation, though he has also overseen an increase in domestic oil production and promised motorists he will keep petrol prices low. Both candidates know that U.S. voters are particularly sensitive to the price of their gasoline, in a land … [Read more...]

Tariffs on China’s carmakers? Chinese joint ventures and on-shoring would be better

Both the U.S. and the EU are targeting China’s carmakers with tariffs. China is accused of providing state support that allows exported vehicles to be sold at cheaper prices than those of global rivals. The tariffs will allow U.S. and EU carmakers to build up their own domestic supply chains and catch up in competitiveness. But cheap EVs help accelerate the clean transition, so tariffs will only slow it down, certainly in the short term. And … [Read more...]

EU ETS2 for Buildings, Road Transport in 2027: why we need auctions to start early

The EU has established a second emissions trading system (ETS) to put a carbon price on buildings and road transport, the “EU ETS2”. The ETS2 starts in 2027, but monitoring and reporting of ETS2 emissions will begin in 2025. One issue is that an ETS means prices for long-term fuel supply contracts will be affected, so a crucial question for firms is how to hedge their potential exposure, says Ingo Ramming at BBVA writing for the Florence School … [Read more...]

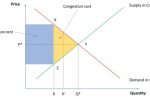

Europe’s cross-border Interconnectors: how JAO auctions optimise energy flows, prices

Interconnectors allow for cross-border flows of energy between two markets that would otherwise not be connected. Through an economic convergence between supply and demand, the cheapest marginal producer located anywhere in these two markets should be able to set market prices. As Jean-Baptiste Vaujour at the Emlyon Business School explains, the central question is to find an optimal allocation of the scarce interconnection capacity between the … [Read more...]

China’s CATL to cut its EV battery costs by up to 50% this year, heralding a price war

China’s CATL, the world’s largest producer of EV batteries, is saying it will slash the cost of its batteries by up to 50% this year as part of a price war with China’s second largest maker, BYD subsidiary FinDreams. The main cause is the overproduction of batteries in China: the oversupply means prices must fall. Muhammad Rizwan Azhar, Waqas Uzair and Yasir Arafat at Edith Cowan University look at the causes and implications, but add that … [Read more...]

Financing Europe’s cross-border Interconnectors to deliver energy security, lower prices: a look at incentives and policies

The EU and its Member States are building out interconnectors to improve security of supply and affordability of electricity through the physical and economic linking of national energy markets into a single, synchronised European market. But each interconnector is expensive, complex and therefore risky. They can span long distances or natural obstacles such as mountains or seas. Significant network planning and adaptation is needed to account … [Read more...]

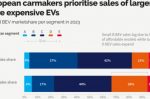

What’s holding up EV adoption? European carmakers are focussing on more profitable SUVs, not affordable cars

European car manufacturers are focussing on more profitable SUV and premium EVs, and this is slowing down the adoption of EVs overall, according to an analysis by T&E. It also means consumers are paying far more than they should be for mass-market compact EVs. To make the point, T&E reveals that the average price of a battery electric car sold in Europe has increased by 39% (+€18,000) since 2015 while in China it has fallen by 53%. If car … [Read more...]

EU ETS or national climate targets? We need both

The choice between using the EU ETS or national climate targets to decarbonise is a false dilemma. We need both, explains Chiara Corradi at T&E writing for the Florence School of Regulation. There are plenty of examples where a carbon market and national targets have delivered good results together, as in Germany, Finland, Denmark and Portugal. And, looking ahead over the next few decades, the right policies should be able to cope with ETS … [Read more...]

Heat Pump + Gas Boiler hybrids can reduce bills and emissions faster than a 100% heat pump roll out

The reduction in buildings emissions is well off track, not least in the residential sector. Something governments and millions of households are well aware of. The problem with replacing a gas boiler with a heat pump is the up-front cost and disruption. Installing the heat pump alone can cost several thousands more than replacing a gas boiler. On top of that, you should properly insulate your home and replace the radiators. Jovana Radulovic at … [Read more...]

Another chapter in Offshore Wind’s stop-go story: New York

New York State should be leading the offshore wind ambitions of the U.S. The region enjoys high capacity factors for offshore wind, especially during the peak winter heating season. And New York is used to being a leader in so many things. That’s why it put its climate reputation at risk in October when the state government announced it would not renegotiate contracts with offshore wind providers Ørsted, Equinor and BP, explains Joseph Webster at … [Read more...]

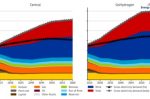

EU Energy Outlook to 2060: power prices and revenues predicted for wind, solar, gas, hydrogen + more

Huangluolun Zhou, Elena Dahlem and Alex Schmitt at Energy Brainpool present their updated “EU Energy Outlook 2060”, modelling how the European energy system will undergo major changes in the coming decades while continuing to guarantee a secure supply and meet its climate targets. What do these developments mean for power prices, revenue potential and risks for solar PV and wind? The two main scenarios are “Central” and “GoHydrogen” for the EU 27 … [Read more...]

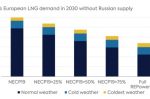

How to manage price risk as the EU shifts from Russian Gas to Renewables

Europe is phasing out Russian gas and replacing it with more renewables. That means there will be greater demand variability and a resulting impact on European spot gas prices. The problem is that long-term contracting, the traditional way for buyers to mitigate spot price risk, is incompatible with Europe’s climate objectives of reducing long term consumption of gas. Kong Chyong at the Center on Global Energy Policy proposes alternative policy … [Read more...]

Investing billions in new cross-border Electricity Transmission capacity can cover its costs within a few years

The huge divergence of electricity prices between nations after the energy crises of 2021 and 2022 exposed Europe’s pressing need to increase cross-border transmission capacity, explain George Dimopoulos, Conall Heussaff and Georg Zachmann at Bruegel. Without it, generation costs will be higher, emissions too, and new generation will continue to be badly congested. The author’s calculations reveal that one additional MW of cross-border capacity … [Read more...]

Why we need a European Central Carbon Bank within the EU ETS framework

The EU Emissions Trading System (EU ETS) is at a critical juncture as it navigates a path towards achieving a net-zero Europe by 2050. Amidst this transformation, the proposal to create the European Central Carbon Bank (ECCB) has sparked a range of criticisms. Some critics have raised valid concerns about the feasibility, necessity, governance, and potential drawbacks of such an institution. Robert Jeszke and Sebastian Lizak at the Centre for … [Read more...]

EU now has 9,000+ “energy communities”: smart, decentralised, flexible generation and consumption

The goal of the EU’s “Clean Energy for all Europeans package” (CEP), adopted in 2019, is to improve the functioning and design of Europe’s energy markets and systems. Luca Arfini, writing for ESCI, explains how, as part of the CEP, new market actors called “active customers/consumers and citizens” and “energy communities” are being established. As variable renewable generation grows, the whole system needs to be more decentralised, smarter and … [Read more...]

- 1

- 2

- 3

- …

- 7

- Next Page »