Donald Trump has always backed oil and gas, and U.S. industry giants donated $7.3m to his campaign, three times more than for his 2020 run. Joe Biden has introduced green energy policies and other transition legislation, though he has also overseen an increase in domestic oil production and promised motorists he will keep petrol prices low. Both candidates know that U.S. voters are particularly sensitive to the price of their gasoline, in a land … [Read more...]

The Fossil Fuel system wastes 2/3rds of its energy before it gets to you. Inefficiency is driving it out (not just emissions)

Today’s fossil energy system is very inefficient: almost two-thirds of all primary energy is wasted in energy production, transportation, and use, before fossil fuel has done any work or produced any benefit. That’s almost 400 EJ wasted, worth over $4.5tn, or almost 5% of global GDP. Two activities - fossil fuel power plants and internal combustion engines - are responsible for almost half the energy waste globally. Daan Walter, Kingsmill Bond, … [Read more...]

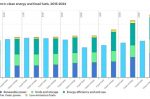

At $2tn, investment in Clean Energy in 2024 is set to be double that for Fossil Fuels

A new report by the IEA reveals that global spending on clean energy technologies and infrastructure is on track to hit $2tn in 2024, driven largely by attractive cost reductions, improving supply chains, energy security, and government policies. This is despite higher financing costs for new projects. The combined investment in renewable power and grids only recently overtook the amount spent on fossil fuels, in 2023. 2024 will see it at double … [Read more...]

58 national Hydrogen strategies published: a step forward, but importers’ and exporters’ plans still need to match up

So far, 58 national hydrogen strategies and roadmaps have been published. Anne-Sophie Corbeau and Rio Kaswiyanto at the Center on Global Energy Policy take a close look, summarising their regularly updated database, the “National Hydrogen Strategies and Roadmap Tracker.” Only 12 countries are planning to become importers, mostly in Asia and Europe. Most of the others plan to be exporters. Many existing fossil fuel exporters want to preserve their … [Read more...]

How to handle rapid Grid load growth: Data Centres can set the template for EVs, Buildings, new Industry

Due to their growing power demand, data centres can set a precedent for how to handle rapid load growth in a way that supports the grid and ensures reliable, resilient, carbon-free electricity. In other words, they can set the template for the coming surges in demand from EVs, buildings electrification, and the new rich-world policies of onshoring industry and manufacturing, explain Alexandra Gorin, Roberto Zanchi and Mark Dyson at RMI. Big, … [Read more...]

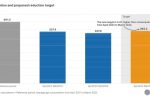

REPowerEU gas reduction is exceeding targets. But that means the same 2025 target can see gas rise again

The REPowerEU policy has done well so far in its aim of ending Europe’s dependency on Russian fossil fuels by 2027. The target of 15% reduction in gas use, compared to the average consumption between April 2017 and March 2022, was exceeded in both 2023 and 2024. The Commission has again set the same 15% target for the coming year. However, by doing so the very many EU countries that have succeeded so well in exceeding that target are effectively … [Read more...]

European support for U.S. gas pipelines can cut inflation, strengthen the energy transition and thwart Putin

Inflation isn’t just politically destabilising. It’s also the enemy of the energy transition, explains Joseph Webster at the Atlantic Council’s Global Energy Center. President Putin understands this, which is why he uses Russia's oil and gas production to stoke global inflation. Hence, to thwart his aims, nations should increase short-term energy production from all sources, including hydrocarbons. Lower energy prices lower inflation and interest … [Read more...]

What China, Germany, and Texas tell us about Capacity Adequacy

As intermittent renewables penetrate further into the grid mix, reliable firm power generation is needed for whenever there is a shortfall. But back-up power, by its nature, has unreliable utilisation rates. And up-front costs for new plants are high, be they gas-fired plants, coal, nuclear, or large-scale storage. That makes future profitability uncertain, and private investors nervous. Hence the need for “capacity mechanisms” that guarantee … [Read more...]

Why isn’t Methane included in the EU’s Carbon Border Adjustment Mechanism?

Robert Kleinberg at CGEP explains why methane isn’t included in the EU’s Carbon Border Adjustment Mechanism (CBAM) which imposes a carbon tax on imported goods. Basically, CO2 emissions are easy to estimate accurately, whereas methane emissions are not. Many methane emissions, even the largest ones, are intermittent and of highly variable duration. Gas leaks vary over many orders of magnitude, and once diffused in the atmosphere leave no local … [Read more...]

Can the six Gulf nations meet their ambitious Renewables deployment plans by 2030?

The six Gulf Cooperation Council (GCC) countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabi, UAE) have all set themselves ambitious renewable energy targets to meet in the next ten years. They are some of the sunniest countries in the world, and existing projects have set records for low solar power costs. But they have a long way to go. In 2022, GCC renewable capacity was 5.7GW, primarily solar PV, out of 165GW of total generating capacity, … [Read more...]

Credit Rating Agencies downgrading Coal, Oil, Gas: climate change is now a clear risk category

Credit rating agencies now clearly recognise that climate change has become its own risk category, explains Tom Sanzillo at IEEFA who summarises his 43-page report. Financially, the coal, oil and gas sectors have served the world for decades. But due to regulatory, legal, economic, financial, political and social concerns, coal is credit negative and oil and gas is no longer positive. Sanzillo’s report charts the gradual erosion of the sector’s … [Read more...]

Tomorrow’s deep water Floating Wind Turbines: the six main design categories explained

The new frontier of offshore wind power is floating wind turbines. That’s because they can be installed in deep water where wind speeds are consistently higher. The new designs have the floating turbines, that bob and sway with the waves and wind, stabilised with ballast or anchored with chains to the seafloor. Emma Edwards at Oxford University looks at the six major categories of design: Spar, Barge, Tension-leg platform, Semi-submersible, … [Read more...]

Half of fossil fuel Methane reduction targets can be met at no net cost. Why isn’t it happening?

We need to cut global methane emissions from fossil fuels by 75% by 2030 to be on target to limit warming to 1.5°C. That equates to 90 Mt of the current total of 120 Mt of annual fossil fuel methane emissions. The IEA says 80 Mt can be avoided through the deployment of known and existing technologies, often at low – or even negative – cost. And the 75% cut needs $170bn in spending to 2030, a very achievable sum given it represents less than 5% of … [Read more...]

EU Carbon Prices halved in a year. But they should rise again

European carbon allowances (EUAs) are trading at around €60/t. One year ago, it was at an all-time high of €100/t. Hæge Fjellheim at Veyt explains why, and why prices should recover. Economically, the drop is due to two main factors: lower gas prices and shrinking energy demand from industry. Politically, additional supply of EUAs came from the EU’s REPowerEU plan to accelerate the energy transition and break dependency on Russian gas by partly … [Read more...]

Two years on, how is Russia’s invasion of Ukraine driving energy security and decarbonisation?

Russia’s invasion of Ukraine has boosted anxiety and therefore action on energy security and dependence on oil and gas. Sanctioning Russian oil and gas imports is an opportunity to replace fossil fuels with low or no carbon alternatives, an opportunity that is being taken. And renewables like wind and solar are by their nature local and therefore good for energy security (though with notable exceptions). Charles Hendry, Ellen Wald, Olga Khakova, … [Read more...]

- 1

- 2

- 3

- …

- 19

- Next Page »