Robert Kleinberg at CGEP explains why methane isn’t included in the EU’s Carbon Border Adjustment Mechanism (CBAM) which imposes a carbon tax on imported goods. Basically, CO2 emissions are easy to estimate accurately, whereas methane emissions are not. Many methane emissions, even the largest ones, are intermittent and of highly variable duration. Gas leaks vary over many orders of magnitude, and once diffused in the atmosphere leave no local … [Read more...]

Is a Carbon Tax the best way to decarbonise the Grid?

Severin Borenstein at the Energy Institute at Haas and Ryan Kellogg at the University of Chicago question whether carbon pricing is the best way to decarbonise the electricity grid. The authors did an empirical analysis of all of the fossil plants in the US. It shows that a CES (clean electricity standard) or zero-emissions subsidies would close down fossil plants in almost the same order as a carbon tax. So using alternative policy tools can … [Read more...]

The metals sector should back global carbon taxes. It’ll be good for business

Most of the metals mining sector has been opposing carbon taxes. This is a foolish mistake that works against their interests, argue Sally Innis, Benjamin Cox, John Steen and Nadja Kunz at the University of British Columbia. The tax on the carbon emissions from mining and producing most metals (with only aluminium and steel being outliers) are small compared to the price of the metal, so a carbon tax will add little to the selling price. But the … [Read more...]

Carbon Taxes have a multiplier effect on clean energy policies

President Biden’s Build Back Better package has already had to be cut back drastically. The climate part of the package is to halve the U.S.’s greenhouse gas pollution from its peak by 2030. Given the limitations on what Biden can do, will tax credits alone (favouring low-carbon solutions) achieve the target, asks Meredith Fowlie at the Energy Institute at Haas. She reviews papers that say it almost certainly won’t. However, the addition of a … [Read more...]

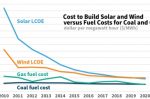

The U.S. now needs a Carbon Tax to transition from Gas to Renewables

Gas emissions must be halved (and coal eliminated) by 2030 to meet President Biden’s goal of a carbon free power sector by 2035. The problem is that gas additions are half the price of new wind and solar installations. Though the clean energy champions are still getting cheaper, so are gas additions. Nikos Tsafos at the Center for Strategic and International Studies looks at the policy options over the next decade for the U.S. The stark fact is … [Read more...]

A carbon tax on car fuel? A fossil car phase-out date is more effective

The EC is working on a carbon tax on car drivers as part of its big climate plan review in June. William Todts at T&E warns that the EC shouldn’t make the same mistake French President Macron made back in 2018 when severe gilets jaunes protests against a fuel price hike made him back down. A very high carbon price, decided by the market, may have the same effect, getting us nowhere. Instead, Todts gives his three point plan. The carbon tax … [Read more...]

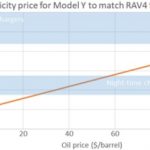

Tesla’s BEVs vs. Toyota’s hybrids: the battle for the future of low emission cars

Which car firm will dominate the future? Tesla and its BEVs or Toyota with its hybrids? Schalk Cloete looks at the cost reductions coming down the line. He says that the hybrids have many more improvements on the way, whereas in terms of performance and efficiency the BEVs are already reaching their peak. Though further and considerable progress in battery technology is coming, it will benefit both. For city driving both will rely on battery … [Read more...]

Net Zero by 2050 technically and economically achievable, says Energy Transitions Commission report

Making Mission Possible, the latest report by the Energy Transitions Commission, describes a net-zero world by mid-century as technically and economically possible. The solutions are already available or close to being brought to market. What is still missing is the will to embrace, rapidly and at scale, the inevitable disruption that will ultimately deliver net-zero emissions, lower air pollution, cheaper energy bills, create new jobs and raise … [Read more...]

Zero U.S. power sector emissions by 2035, says Biden. How?

Joe Biden, the Democratic presidential hopeful, wants to reduce U.S. power sector emissions to zero by 2035. That’s more ambitious than Obama, and more than what Biden promised when campaigning to be the Democrat’s candidate. His emphasis has been on the jobs and investment a green economy will create – language that has more voter appeal than reversing emissions. Meredith Fowlie at UC Berkeley’s Energy Institute at Haas reviews the promises … [Read more...]

New U.S. climate bill is unprecedented in “ambition, concrete details, and urgency”

Mark Silberg, Alisa Petersen and Ben Holland at RMI pick out six highlights from a new U.S. climate bill and accompanying report that they describe as unprecedented in “ambition, concrete details, and urgency”. The Democrat-sponsored “Moving Forward Act” passed the House at the start of July and now goes to the Senate. Though regional commitments already get the U.S. halfway to meeting the 1.5°C goal, federal action is needed for the rest. … [Read more...]

Why a Carbon Border Tax? Because existing tariffs favour dirty over clean imports

Carbon border adjustments are carbon taxes imposed on carbon intensive imports that have not been carbon-taxed at source. It’s a good way to penalise “dirty” goods and remove any competitive advantage the exporter gains from not paying for its pollution. Regions across the world are trying to figure out the best way – how, when, if at all - to roll them out. But Joseph Shapiro, writing for the Energy Institute at Haas, points out that the … [Read more...]

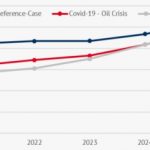

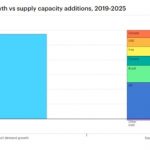

Bounceback or Recession? Modelling the impact on electricity prices to 2025

Carlos Perez Linkenheil at Energy Brainpool models three scenarios to understand the factors that are having the biggest impact on – and thereby make predictions for - electricity prices, revenues, energy source merit order, and emissions in the EU. Other parameters in the scope of their analysis include oil prices, gas prices, commodities markets, carbon taxes, and the EUA/emissions market. Clearly, collapsing prices are profoundly distorting … [Read more...]

Stimulus opportunity: Hand all carbon taxes to households

Governments worldwide now have the opportunity to radically rethink how household consumption can be stimulated, and where that money can come from. And every serious politician knows a radical change in fiscal policy is a rare opportunity to shape perceptions and values. This could be that moment for carbon taxes. Gerard Wynn at IEEFA first notes the success they have had in reducing emissions in the EU. With a rise in the CO2 price on the … [Read more...]

Coronavirus bailouts should be explicit, not hidden by CO2 tax cuts. And nothing for Oil

Many industries will be pleading their case for a Coronavirus bailout. Severin Borenstein at the Energy Institute at Haas explains why the oil industry should not be one of them. Oil prices, already on the slide, are indeed sinking lower thanks to the pandemic. But decarbonisation should be sending them that way anyway. And the oil price has always be artificially high thanks to the OPEC cartel and weak or complicit “competition” from non-OPEC … [Read more...]

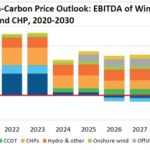

Poland’s PGE: profits from Renewables can replace declining Coal’s

Poland’s PGE is one of Europe’s most fossil fuel intensive energy firms. Coal makes up around 90% of its electricity generation. It’s been investing around PLN 28bn ($7.2bn, €7bn) to build three new coal power plant units, acquire the Polish coal assets of France’s EDF, and upgrade its existing fleet to meet air quality standards. But a new and detailed report from IEEFA warns that the profitability of these investments will decline in the 2020s … [Read more...]