The worst expectations for oil prices never materialised, thank goodness. In mid-March a year ago Brent reached $114 and WTI $103 a barrel. By the same time this year it was $72 and $66 respectively. That’s despite no end in sight for the Russia-Ukraine war, the trigger to the 2022 price escalation and global crisis. Carole Nakhle at the University of Surrey explains how today’s forecasts are similarly uncertain. She points at conflicting … [Read more...]

Coronavirus bailouts should be explicit, not hidden by CO2 tax cuts. And nothing for Oil

Many industries will be pleading their case for a Coronavirus bailout. Severin Borenstein at the Energy Institute at Haas explains why the oil industry should not be one of them. Oil prices, already on the slide, are indeed sinking lower thanks to the pandemic. But decarbonisation should be sending them that way anyway. And the oil price has always be artificially high thanks to the OPEC cartel and weak or complicit “competition” from non-OPEC … [Read more...]

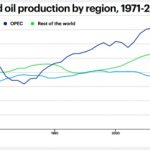

60 years on, OPEC should take control again, cut supply, raise prices to fund its Transition

OPEC is often seen as no friend of the Transition. But Greg Muttitt points out that, although it did take an anti-climate stance in the 1990s, by the 2000s it had stepped back from climate negotiations, while some OPEC members became supporters. Muttitt says that, celebrating its 60th anniversary, it’s time for OPEC to remember its roots and organise its members to take control of their own destiny in the face of the inevitable rise of clean … [Read more...]

OPEC is driving itself to irrelevance with farcical aplomb

It took months of delays but even before the cartel’s latest ministers meeting began in Vienna, the Saudis and Russians rendered it meaningless by largely deciding an outcome that failed to surprise the market. Not that long ago, a meeting of the Organization of Petroleum Exporting Countries (OPEC) carried great weight in the global energy market and was accompanied by intense anticipation. The powerful oil producer’s cartel at one point held … [Read more...]

Low oil price alongside rise in renewables sees Oil & Gas slide to bottom of S&P 500

In December we reported that in 2018, the U.S. became the world's leading oil producer for the first time since the 1970s. It is tipped to produce 12 million barrels of oil per day this year (up approximately 10% year on year), and over two-thirds of it will come from shale producers. But the consequent squeeze on the oil price meant U.S. Oil & Gas firms ended the second year in a row at the bottom of the stock market. IEEFA’s director of … [Read more...]

The Saudi Dilemma: To Cut Or Not To Cut

Following November's G20 meeting in Buenos Aires and the ensuing OPEC meeting earlier this month, the Kingdom of Saudi Arabia is still left scratching its head. 90% of the Kingdom's income comes from Oil. As US shale keeps piling on the pressure, some argue they have enough in the bank to fund higher production levels and even lower prices for another 10-years. But their Vision 2030 initiative, to radically diversify their economy, also requires … [Read more...]

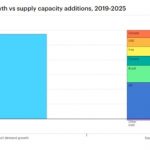

$100 oil is a distinct possibility

It wasn't long ago that blistering U.S. shale growth was thought to have given rise to lower oil prices for the foreseeable future. But there are signs this could soon change, Nick Cunningham writes. Various factors are set to result in the potential disappearance of 2 million barrels of oil a day in the fourth quarter of this year, driving prices up into the three-figure range. Courtesy of Oilprice.com. … [Read more...]