Ending reliance on Russian fossil exports will need the U.S. and Europe to work together, explain Joseph Majkut, Nikos Tsafos and Ben Cahill at the Center for Strategic and International Studies. The U.S. is the world’s largest oil and gas producer and is able to increase output. At the same time, it must meet global emissions targets. The way to do it is to increase fossil exports temporarily whilst improving its carbon reduction measures (e.g. … [Read more...]

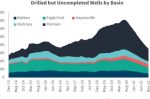

U.S. shale production is rising. But by how much more, and how fast?

The dramatic increase in gas and electricity prices worldwide has raised concerns about energy security. It why U.S. shale production is rising. But by how much more, and how fast? Ben Cahill at CSIS looks at lessons learned over the last ten years by the sector to understand the drivers. Previously, shale firms grew so fast that many investors lost a lot of money. Then, the 2020 oil shock imposed discipline and firms preserved cash, but that … [Read more...]

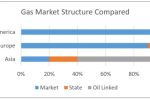

The Gas Crunch: EU and China can share lessons on Energy Security and Renewables Integration

With adversity comes opportunity. The global gas crunch has hurt countries around the world but has also made them appreciate their common concerns. That has provoked policy-makers to take a serious look at current and future energy security policies. In the EU the competitive gas markets, enabled by short-term spot markets, has reminded us of the value of long-term contracts when prices are volatile and rising. Meanwhile, China’s … [Read more...]

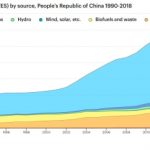

China’s 14th Five-Year Plan will reshape its growing Gas sector

Demand for natural gas in China is set to continue its rise, increasing by 7% to 9% annually to reach up to 500 bcm by 2025, explains Sylvie Cornot-Gandolphe at the IFRI Centre for Energy & Climate. Domestic gas production has continued its significant growth too, driven by a surge in shale gas. Even then, gas imports – both pipeline and LNG - should increase to fulfil the rising supply/demand gap. This growing importance of gas in the energy … [Read more...]

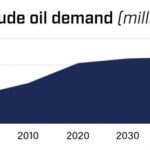

What can Oil producers learn from a sunset Coal industry?

Although fossil fuels are being replaced by clean energy they are not going away. Even coal is not in decline, it’s just peaked globally: declining in mature economies, still rising in developing ones. Henning Gloystein at the Eurasia Group, writing for the Atlantic Council, asks to what extent oil will follow coal. Oil consumption is still growing – 1% this year - though at a much slower rate than before. As with coal, a re-focus onto cleaner … [Read more...]

IEA: Big energy firms cannot ignore the Transition

Alessandro Blasi and Alberto Toril of the IEA look at how oil and gas majors are still investing very little - of the order of a single percentage point - in clean energy projects. What they are doing in response to new anti-fossil climate policies is increasing investment in short cycle projects that generate cash and returns quickly, minimising risk. This is a questionable strategy, given the fundamental shift away from thermal power and fossil … [Read more...]

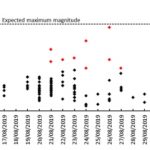

UK fracking earthquakes: why the world’s “toughest” safety rules failed to predict them

In August this year Lancashire experienced the largest fracking-induced earthquake recorded in the UK. Fracking was suspended. Legislators discussed a complete ban. As a result, serious questions are being asked about the effectiveness of the safety regulations, given the operating company, Cuadrilla, predicted there was a “low-likelihood” of such events occurring. And given the UK’s “traffic light system” (TLS) is the most stringent TLS in the … [Read more...]

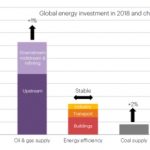

IEA: Global energy investment stabilises at $1.8tn after 3 years of decline

Three consecutive years of declining global energy investment has ended. But it’s not risen, just stabilised at $1.8tn, according to the IEA’s latest report World Energy Investment 2019. To meet the Paris targets investment in efficiency needs to rise substantially, and double by 2030 for renewables: they have stalled for both. To meet soaring global energy demand oil and gas investments need to rise too. That demand is seeing cheap coal still … [Read more...]

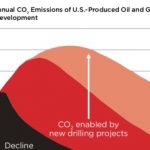

A grassroots fightback against Trump and U.S. Oil & Gas is underway

As the 116th Congress commences, in the wake of dire reports from climate scientists, the debate over U.S. climate policies has taken a welcome turn towards bold solutions. Capitol Hill is alive once again with policy proposals that edge towards the scale required to address the crisis we’re in. A new study by Kelly Trout of Oil Change International, along with 17 partner organisations, makes it clear that managing a rapid and equitable decline … [Read more...]

Low oil price alongside rise in renewables sees Oil & Gas slide to bottom of S&P 500

In December we reported that in 2018, the U.S. became the world's leading oil producer for the first time since the 1970s. It is tipped to produce 12 million barrels of oil per day this year (up approximately 10% year on year), and over two-thirds of it will come from shale producers. But the consequent squeeze on the oil price meant U.S. Oil & Gas firms ended the second year in a row at the bottom of the stock market. IEEFA’s director of … [Read more...]