There are three big reasons why Europe’s auto industry should be given binding targets to increase the green steel content of their cars through to 2040. First, conventional steel production is a high-emissions activity, and both users and producers are struggling to bring it down. Second, emerging green steel producers need to secure major guaranteed users (the auto industry is steel’s second biggest customer) as this is their greatest … [Read more...]

A global breakdown of how the energy sector is paid for: by governments, private firms, households

What are the sources of investment and sources of finance in the energy sector? Cecilia Tam, Paul Grimal, Jeanne-Marie Hays and Haneul Kim at the IEA summarise insights extracted from the IEA’s latest flagship World Energy Investment report which this year has dug much deeper into the subject. They look at the capital structure (debt versus equity) of energy investments in assets and companies. They look at the entities making the investments, … [Read more...]

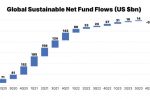

ESG investing: a look at actual performance, constraints, fund flows, regional differences

Inflows into ESG (environmental, social, and governance) funds remain strong, especially in Europe. That’s despite high interest rates and the boost to oil and gas from Russia’s invasion of Ukraine. According to a new report by Ramnath Iyer at IEEFA, in 2023 the performance of ESG funds and exchange-traded funds (ETFs) matched or surpassed that of traditional funds and ETFs. Morningstar figures reveal that sustainable funds had a median return of … [Read more...]

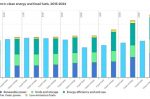

At $2tn, investment in Clean Energy in 2024 is set to be double that for Fossil Fuels

A new report by the IEA reveals that global spending on clean energy technologies and infrastructure is on track to hit $2tn in 2024, driven largely by attractive cost reductions, improving supply chains, energy security, and government policies. This is despite higher financing costs for new projects. The combined investment in renewable power and grids only recently overtook the amount spent on fossil fuels, in 2023. 2024 will see it at double … [Read more...]

Financing Hydrogen projects in Emerging Markets and Developing Countries

Financing the new hydrogen economy is already a challenge. Financing hydrogen production in Emerging Markets and Developing Countries (EMDC) is an even bigger one, yet vitally important for supplying richer nations with hydrogen while creating new industries in the EMDC. This month, the World Bank Energy Sector Management Assistance Program (ESMAP) together with the Government of the Netherlands and Invest International organised a Financing … [Read more...]

Low Emission Hydrogen: creating markets to get buyers to make firm commitments

Low emission hydrogen is expected to play an important role in global decarbonisation, though costs today are very high and must come down. Economies of scale will help, but production is yet to pick up pace as there are inadequate ‘demand signals’ which result in financial risks for project developers. Kapil Narula and Luciano Caratori of Climate Champions Team, Laurent Antoni at IPHE, and Nigel Topping (former UN Climate Change High-Level … [Read more...]

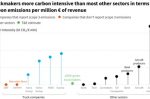

Investors beware: per € of revenue, truckmakers are more carbon intensive than oil, steel, cars (but not coal!)

Truckmakers are a more carbon intensive investment, per € of revenue, than oil, steel and cars. The only major sector that's worse is coal mining, says a new study by T&E. For investors that are counting the emissions of their investments, this will become clear when truckmakers are forced to report their Scope 3 emissions next year. Truckmakers therefore risk losing access to these investors. Until now, truckmakers have got away with it … [Read more...]

What China, Germany, and Texas tell us about Capacity Adequacy

As intermittent renewables penetrate further into the grid mix, reliable firm power generation is needed for whenever there is a shortfall. But back-up power, by its nature, has unreliable utilisation rates. And up-front costs for new plants are high, be they gas-fired plants, coal, nuclear, or large-scale storage. That makes future profitability uncertain, and private investors nervous. Hence the need for “capacity mechanisms” that guarantee … [Read more...]

Strict rules stop Green Hydrogen production diverting clean power from the grid. What are they?

Green hydrogen must be made from green electricity. But the electricity used for making it must fulfil stricter requirements than conventional green electricity. Matthis Brinkhaus at Energy Brainpool describes the criteria by which hydrogen can be designated as 100% renewable: Additionality; Additionality Plus; Temporal correlation, simultaneity; Geographical correlation, regionality. Brinkhaus points at where exceptions can be made, and where … [Read more...]

Credit Rating Agencies downgrading Coal, Oil, Gas: climate change is now a clear risk category

Credit rating agencies now clearly recognise that climate change has become its own risk category, explains Tom Sanzillo at IEEFA who summarises his 43-page report. Financially, the coal, oil and gas sectors have served the world for decades. But due to regulatory, legal, economic, financial, political and social concerns, coal is credit negative and oil and gas is no longer positive. Sanzillo’s report charts the gradual erosion of the sector’s … [Read more...]

Financing Europe’s cross-border Interconnectors to deliver energy security, lower prices: a look at incentives and policies

The EU and its Member States are building out interconnectors to improve security of supply and affordability of electricity through the physical and economic linking of national energy markets into a single, synchronised European market. But each interconnector is expensive, complex and therefore risky. They can span long distances or natural obstacles such as mountains or seas. Significant network planning and adaptation is needed to account … [Read more...]

The European Green Deal isn’t coping with a turbulent world. What must change?

The European Green Deal was not designed to cope with the extraordinary series of overlapping crises the world has been facing. Though the EU has ultimately been reinforced through crises, that may not continue, explain Marc-Antoine Eyl-Mazzega and Diana-Paula Gherasim at IFRI who summarise their study “How Can the Green Deal Adapt to a Brutal World?” Costs are rising and investment is not keeping pace. Dependence on China and the burst of … [Read more...]

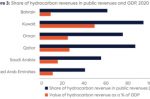

Gulf States are investing in Carbon Capture to maintain Hydrocarbon business

The Gulf region wants to maintain their substantial revenues from hydrocarbons in a decarbonising world. One way to do that is to invest in carbon capture, to make cleaner and more marketable fossil fuel products. Megren Almutairi and Karen Young at CGEP look at their current plans and future prospects. Right now, about 10% of CO2 captured globally is in the industrial facilities of the Gulf States. Their national oil companies boast some of the … [Read more...]

Hydrogen: most nations’ plans to export to Europe don’t match reality. The EU should make it itself

The EU’s RePowerEU plan, quickly made in response to Russia’s invasion of Ukraine, aims to produce 20m tonnes of renewable hydrogen by 2030, with half coming from imports. Here, T&E summarise their report that concludes this is unrealistic. The report looks at six key countries with plans to export hydrogen to the EU: Norway, Chile, Egypt, Morocco, Namibia and Oman. T&E says these countries combined would only be able to deliver a quarter … [Read more...]

Is global energy security being used as an excuse to build more U.S. LNG export capacity?

Europe’s energy security is being used as an excuse in the U.S. to build more LNG terminals than are actually needed, argues Ana Maria Jaller-Makarewicz at IEEFA. European gas demand is expected to keep falling. Even with U.S. projects that are currently under construction, its LNG export capacity in 2030 will be 76% higher than Europe’s forecast demand. The U.S. should seriously re-evaluate its strategy or risk overinvestment, says … [Read more...]

- 1

- 2

- 3

- …

- 11

- Next Page »