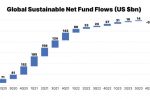

Inflows into ESG (environmental, social, and governance) funds remain strong, especially in Europe. That’s despite high interest rates and the boost to oil and gas from Russia’s invasion of Ukraine. According to a new report by Ramnath Iyer at IEEFA, in 2023 the performance of ESG funds and exchange-traded funds (ETFs) matched or surpassed that of traditional funds and ETFs. Morningstar figures reveal that sustainable funds had a median return of … [Read more...]

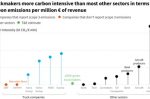

Investors beware: per € of revenue, truckmakers are more carbon intensive than oil, steel, cars (but not coal!)

Truckmakers are a more carbon intensive investment, per € of revenue, than oil, steel and cars. The only major sector that's worse is coal mining, says a new study by T&E. For investors that are counting the emissions of their investments, this will become clear when truckmakers are forced to report their Scope 3 emissions next year. Truckmakers therefore risk losing access to these investors. Until now, truckmakers have got away with it … [Read more...]

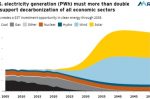

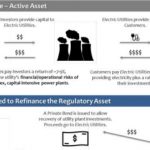

Electric Utilities: ESG investors should invest in, not avoid, the high-carbon emitters

Environmental, social, and governance (ESG) ratings point climate-conscious investors away from companies that are not decarbonising fast enough (or at all!). But surely they should be doing the exact opposite when it comes to climate-critical sectors like electric utilities, explain Tricia Holland, Ryan Foelske, Ella Warshauer, Jon Rea, Sarah LaMonaca and Uday Varadarajan at RMI. Of course, that presents a new challenge. The investor first needs … [Read more...]

Credit Rating Agencies: a guide to pricing in long-term climate risks

Nobody wants share, stock and bond prices to fall off a cliff unexpectedly. But while Credit Rating Agencies (CRAs) continue to evaluate based on short-term policy changes and market forces without specifically accounting for climate risks, that’s what could happen. IEEFA have published their guides to how CRAs can adapt – without throwing out – their existing models to integrate environmental, social and governance (ESG) credit risks. Hazel … [Read more...]

Big Consultancies are now advising on climate change. Will it conflict with their business-as-usual work?

The world’s top management consultancies - like BCG, Accenture, PwC, EY, McKinseys - who for decades have advised the biggest polluters, are now rushing into the business of helping companies cut emissions to become more sustainable, explains Emma Thomasson at Clean Energy Wire. The necessary expertise is in very short supply, so they are retraining staff, poaching environmental experts, and buying up smaller specialist firms. BCG is even running … [Read more...]

2023 lookahead for Sustainable Finance: EU Taxonomy, ESG ratings, corporate disclosure laws, Europe’s “IRA”

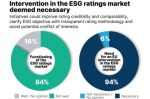

What will be the big issues for sustainable finance in 2023? Luca Bonaccorsi at Transport & Environment points at four. Firstly, the EU Taxonomy defines what counts as “green” investment. There has been much criticism of the inclusion of gas, and critics will continue publishing their analyses of what is truly sustainable and what is greenwash. Next, ESG ratings have also been severely criticised. They are an investor’s main tool for capital … [Read more...]

EC Consultation: ESG ratings need regulation to fix inconsistencies and bias

There are multiple problems with ESG ratings and that’s why they need to be properly regulated, says Hazel James Ilango at IEEFA. Different ratings agencies have different methodologies that are difficult to compare. They can lack transparency and be biased due to industry, geographical location or company size. As for a company’s impact on the planet and society, it can be overrated or underrated due to the aggregation of Environmental, Social … [Read more...]

How to ramp up Green Mortgages for climate-friendly house improvements

Green mortgages are used to finance climate-friendly house improvements. In the U.S. they already exist, but need to be made far more accessible and marketed widely. Greg Hopkins at RMI cites their report “Build Back Better Homes: How to Unlock America’s Single-Family Green Mortgage Market” to explain that the financial markets are looking increasingly favourably at lending that is certified as ESG (environmental, social, and governance). … [Read more...]

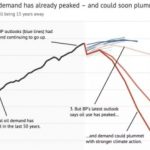

Five key metrics investors need to steer Oil and Gas firms into decarbonisation

If the oil and gas industry won’t commit to meaningful strategies and milestones to decarbonise, investors must make them, say Ben Ratner at the Environmental Defense Fund and Erin Blanton at Columbia University. Already, Covid has shown how vulnerable the sector is to unexpected change. If the sector refuses to factor in rising decarbonisation ambitions and policies across the globe that vulnerability will continue for decades. At the same time, … [Read more...]

Defining green investments, ending greenwash: the EU’s new Taxonomy Regulation

When the EU Commission’s new Taxonomy Regulation is approved, expected in March, it will provide the legal framework to define what is a truly ‘green’ investment. As Luca Bonaccorsi at Transport & Environment explains, right now asset managers and national authorities are free to define what is green, allowing some to greenwash investments in things like oil and pesticides. The Taxonomy's purpose is to reduce ambiguity and therefore increase … [Read more...]

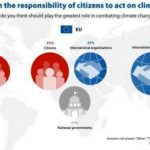

New EU green investment rules to make conservative German savers bite

Germany’s past renewables successes have been underpinned by government and public funds and guarantees. Its future will depend more and more on private investment, which means citizens and small investors must opt to put their money into green investments and take on risk. The good news is that surveys show citizens are very willing. The bad news is that few are actually doing it. Is it because the banks aren’t promoting sustainable investments, … [Read more...]

“Responsible” ESG investments hit $20tn, a quarter of the world’s professionally managed total

ESG (Environmental, Social and Governance) factors measure the sustainability and ethical impact of an investment. ESG includes the energy sector, and the amounts spent show it’s no longer just an ethical choice, says The Rocky Mountain Institute’s Todd Zeranski. It doesn’t just save the planet, it saves our pensions. Why? From regulatory penalties to the cost of climate clean-up, fossil fuel investments are getting too risky and expensive. Those … [Read more...]