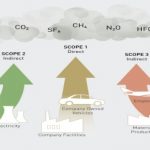

The decarbonisation of any sector requires not just the right technologies and processes, but the right monitoring of where the emissions are in the supply chain. That monitoring allows the producer to focus on where the main problems are. It also allows buyers and investors to know what’s really happening, and use their power to demand a low emission product. Nicole Labutong and Wenjuan Liu at RMI look at the quality of the monitoring of the … [Read more...]

Global inflation: high borrowing costs threaten the continued growth in Renewables. What must be done?

Over the last decade, investors and governments got used to two supportive trends: relatively cheap capital from low interest rates, and steadily falling costs. However, this changed as the world emerged from the Covid pandemic and into the global energy crisis. In a new era of high interest rates, the impressive growth in renewables deployment is under threat, explain Tim Gould, David Fischer, Paolo Frankl and Heymi Bahar at the IEA. Renewables … [Read more...]

Most investors still aren’t factoring in climate risks. Oil and Gas firms face virtually no additional borrowing costs

Extreme weather events are becoming more frequent due to climate change. At the same time, global decarbonisation is changing the economics of the energy sector. Yet credit ratings agencies aren’t consistently factoring in the risk of climate-related change into borrowing costs, explains Matt Burke at the University of Oxford. For example, oil and gas firms are facing virtually no additional borrowing costs. It’s a similar story for governments … [Read more...]

Wind (and Solar) need their own Financial Transmission Rights to hedge their unique congestion risks

Financial Transmission Rights (FTRs) help generators and load-serving entities hedge congestion-related risk. Transmission congestion causes a divergence between wholesale power prices where it is generated and the trading hubs where it is delivered and sold. Because the congestion, and therefore the risk, varies over time it is particularly important to variable renewables. That uncertainty increases investor risk which potentially slows … [Read more...]

Corporations, Cities, Financial Institutions: can private collective action plug the global emissions gap?

Non-state actors - corporations, cities, and financial institutions – are making their own impact on emissions reductions. We don’t just have to rely on governments, explain James Newcomb, Jun Ukita Shepard and Laurens Speelman at RMI. Case studies of harnessing private collective action already exist, and they are significant. Take Power Purchase Agreements (PPAs). In the U.S., corporates ramped up annual renewables procurements from 0.1 GW to … [Read more...]

Decommissioning coal, oil, gas: how funds can buy and retire the assets

Companies that want to retire their CO2-emitting assets (coal, oil, gas) can struggle to afford the cost of the decommissioning process. Brad Handler and Morgan Bazilian at the Payne Institute for Public Policy, writing for the World Economic Forum, explain how the creation of a new financial instrument, the 'carbon retirement portfolio' (CRP), could be a solution. In essence, it’s simple. Investors create a fund that buys the asset and takes the … [Read more...]

Oil’s decline will weaken its political influence

2020 was another bad year for the oil and gas industry. The pandemic made it worse but it was not the cause: a decline has been going on for a long time. Energy firms in the S&P 500 (overwhelmingly oil and gas) make up 2.3% of the total value, down from 16% just over a decade ago, and 30% forty years ago. Clark Williams-Derry and Tom Sanzillo at IEEFA explain why, how and what the likely consequences are for oil firms. For many years it’s … [Read more...]

Five key metrics investors need to steer Oil and Gas firms into decarbonisation

If the oil and gas industry won’t commit to meaningful strategies and milestones to decarbonise, investors must make them, say Ben Ratner at the Environmental Defense Fund and Erin Blanton at Columbia University. Already, Covid has shown how vulnerable the sector is to unexpected change. If the sector refuses to factor in rising decarbonisation ambitions and policies across the globe that vulnerability will continue for decades. At the same time, … [Read more...]

Greece: lignite asset sale failure could shift focus to electricity market reform and renewables

This month Greece’s Public Power Corporation (PPC) admitted its effort to sell a third of its lignite assets had failed. Dr. Nikos Mantzaris, of the think tank The Green Tank, gives his explanation for why the numbers never added up for the buyers. He now fears the PPC will simply sweeten the deal. Instead, Greece should abandon failing lignite assets, reform the electricity market and refocus on renewables. … [Read more...]

New tool to show whether companies’ climate strategy matches their public ambitions

By now we’re used to stats that show what would happen if everyone in the world had the same carbon footprint as a European, or an American, someone in China, or indeed anywhere. According to the consultancy right. based on science, they have now created a way of modelling the same projections, except for specific companies. The model also number-crunches a company's climate strategy to work out whether they are going to help or hinder the race … [Read more...]