Small Modular Reactors (SMRs) are being presented as the next generation of nuclear technology. While traditional plants face cost overruns and safety issues, SMRs are seen by their champions as cheaper, safer, and faster to deploy. But Ed Lyman at UCS cites evidence that cast these claims into doubt. In five sections of this article, he lists the reasons why. SMRs are not more economical than large reactors. SMRs are not generally safer or more … [Read more...]

Financing Hydrogen projects in Emerging Markets and Developing Countries

Financing the new hydrogen economy is already a challenge. Financing hydrogen production in Emerging Markets and Developing Countries (EMDC) is an even bigger one, yet vitally important for supplying richer nations with hydrogen while creating new industries in the EMDC. This month, the World Bank Energy Sector Management Assistance Program (ESMAP) together with the Government of the Netherlands and Invest International organised a Financing … [Read more...]

Carbon Dioxide Removal: here’s what the start-ups want from policymakers, partners

The scaling up of a global carbon dioxide removal (CDR) industry is facing significant challenges over proven results and therefore funding. Guy Wohl and Emily Rogers at RMI have interviewed the CEOs of four start-ups who feature in RMI’s Applied Innovation Roadmap (AIR) report for CDR. “Rewind” is developing a biogenic CDR (bCDR) approach that sinks forestry residual plant matter in the Black Sea to store the plant-embedded carbon for centuries. … [Read more...]

Solar PV technology improvements are rapid. But how do you test the long-term reliability of the new designs?

Solar PV module technology moves fast, and is delivering improvements continuously. So fast that it’s no trivial matter to judge the long-term reliability of the changes. It’s a crucial issue as modules, once deployed, are expected to deliver results over lifetimes that span decades. Sara Fall and Jarett Zuboy at NREL describes a process designed to identify and address potential reliability problems quickly, before they are observed in the … [Read more...]

Electricity Market Design – creating the stimulus for competitive Offshore Wind within the internal energy market

Ahead of the upcoming discussion in Brussels (September 18, 15:00, Polish Embassy REGISTER HERE) on how to stimulate renewable investment, see below for a reminder of what was discussed at our conference before the summer. This time around, following an open address by Wanda Buk, VP Regulatory Affairs at PGE, PGE Baltica's CEO, Arkadiusz Seksciński will be joined by Thor-Sten Vertmann, Electricity Market Design (EMD) expert within Ms Kadri … [Read more...]

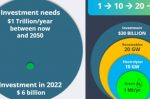

Financing Renewable Hydrogen globally: ramp up to 2030 only needs $150bn/year

Dolf Gielen, Priyank Lathwal and Silvia Carolina Lopez Rocha at the World Bank present a thorough review of the pathway to financing global clean renewable hydrogen over the coming decades. The wind and solar that powers production will continue to get cheaper, and so will electrolyser costs as they scale up. Nevertheless, the total financing will still be considerable. World Bank analysis shows around $30tn between now and 2050 will be needed … [Read more...]

Credit Rating Agencies: a guide to pricing in long-term climate risks

Nobody wants share, stock and bond prices to fall off a cliff unexpectedly. But while Credit Rating Agencies (CRAs) continue to evaluate based on short-term policy changes and market forces without specifically accounting for climate risks, that’s what could happen. IEEFA have published their guides to how CRAs can adapt – without throwing out – their existing models to integrate environmental, social and governance (ESG) credit risks. Hazel … [Read more...]

Renewables “cost of capital” in Europe lower than oil, gas, coal. What the U.S. and China can learn

The ultimate price of anything is highly dependent on the cost of capital needed to put it in place. That cost reflects the risks financial markets perceive. And policy certainty reduces risk. Gireesh Shrimali, Christian Wilson and Xiaoyan Zhou at Oxford University, writing for WEF, summarise their global study which shows the cost of capital for different energy technologies, and therefore which ones will trend upwards and dominate. They cover … [Read more...]

Wind (and Solar) need their own Financial Transmission Rights to hedge their unique congestion risks

Financial Transmission Rights (FTRs) help generators and load-serving entities hedge congestion-related risk. Transmission congestion causes a divergence between wholesale power prices where it is generated and the trading hubs where it is delivered and sold. Because the congestion, and therefore the risk, varies over time it is particularly important to variable renewables. That uncertainty increases investor risk which potentially slows … [Read more...]