The newly elected Labour government in the UK is promising to create a state-owned entity, GB Energy, to drive forward its energy transition. Robert Johnston at CGEP explains what it is, and how it could be a model for other nations. Up until now, the policy toolkit of high-income OECD countries has primarily been the use of subsidies, tax credits, government procurement, R&D grants, trade policy and the like. GB Energy will directly invest … [Read more...]

A global breakdown of how the energy sector is paid for: by governments, private firms, households

What are the sources of investment and sources of finance in the energy sector? Cecilia Tam, Paul Grimal, Jeanne-Marie Hays and Haneul Kim at the IEA summarise insights extracted from the IEA’s latest flagship World Energy Investment report which this year has dug much deeper into the subject. They look at the capital structure (debt versus equity) of energy investments in assets and companies. They look at the entities making the investments, … [Read more...]

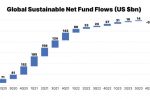

ESG investing: a look at actual performance, constraints, fund flows, regional differences

Inflows into ESG (environmental, social, and governance) funds remain strong, especially in Europe. That’s despite high interest rates and the boost to oil and gas from Russia’s invasion of Ukraine. According to a new report by Ramnath Iyer at IEEFA, in 2023 the performance of ESG funds and exchange-traded funds (ETFs) matched or surpassed that of traditional funds and ETFs. Morningstar figures reveal that sustainable funds had a median return of … [Read more...]

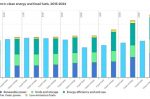

At $2tn, investment in Clean Energy in 2024 is set to be double that for Fossil Fuels

A new report by the IEA reveals that global spending on clean energy technologies and infrastructure is on track to hit $2tn in 2024, driven largely by attractive cost reductions, improving supply chains, energy security, and government policies. This is despite higher financing costs for new projects. The combined investment in renewable power and grids only recently overtook the amount spent on fossil fuels, in 2023. 2024 will see it at double … [Read more...]

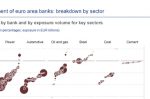

90% of Euro-area Banks’ corporate lending is vulnerable to EU climate goals, says ECB

A new European Central Bank (ECB) analysis reveals that the corporate loan portfolios of 90% of Euro-area banks are significantly misaligned with EU climate goals. The report examines loans to six sectors chosen because of their exposure to a decarbonising world: power, automotive, oil & gas, steel, coal and cement. Everything from new decarbonisation rules through to changing consumer behaviour is altering the risk profile of loans, which … [Read more...]

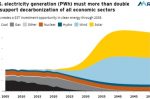

Global inflation: high borrowing costs threaten the continued growth in Renewables. What must be done?

Over the last decade, investors and governments got used to two supportive trends: relatively cheap capital from low interest rates, and steadily falling costs. However, this changed as the world emerged from the Covid pandemic and into the global energy crisis. In a new era of high interest rates, the impressive growth in renewables deployment is under threat, explain Tim Gould, David Fischer, Paolo Frankl and Heymi Bahar at the IEA. Renewables … [Read more...]

Most investors still aren’t factoring in climate risks. Oil and Gas firms face virtually no additional borrowing costs

Extreme weather events are becoming more frequent due to climate change. At the same time, global decarbonisation is changing the economics of the energy sector. Yet credit ratings agencies aren’t consistently factoring in the risk of climate-related change into borrowing costs, explains Matt Burke at the University of Oxford. For example, oil and gas firms are facing virtually no additional borrowing costs. It’s a similar story for governments … [Read more...]

IMF adds climate change to its economic risk assessments, pilots new lending tools

The International Monetary Fund (IMF) says its primary role is to help countries tackle balance of payments problems, stabilise their economies, and restore sustainable economic growth. Dileimy Orozco and Njavwa Sanga at E3G and Alexia Meynier at ENGIE Impact explain that the IMF has now elevated climate change to one of its top priorities, considering it a systemic risk for the stability of the global economy and financial system. Until now, the … [Read more...]

H2 Green Steel has raised billions in 3 years: a case study of Industrial Project Finance

The financing of H2 Green Steel (H2GS), founded in 2020, can be taken as a template for capital intensive industrial first-of-a-kind projects that must raise billions quickly to build from scratch and go live. Shravan Bhat and Asia Salazar at RMI describe H2GS’s financing journey to reveal five key lessons for raising funds. Against the usual logic, large, diverse, equity investor pools can work (H2GS counts over 20 different equity investors). … [Read more...]

Electric Utilities: ESG investors should invest in, not avoid, the high-carbon emitters

Environmental, social, and governance (ESG) ratings point climate-conscious investors away from companies that are not decarbonising fast enough (or at all!). But surely they should be doing the exact opposite when it comes to climate-critical sectors like electric utilities, explain Tricia Holland, Ryan Foelske, Ella Warshauer, Jon Rea, Sarah LaMonaca and Uday Varadarajan at RMI. Of course, that presents a new challenge. The investor first needs … [Read more...]

Credit Rating Agencies: a guide to pricing in long-term climate risks

Nobody wants share, stock and bond prices to fall off a cliff unexpectedly. But while Credit Rating Agencies (CRAs) continue to evaluate based on short-term policy changes and market forces without specifically accounting for climate risks, that’s what could happen. IEEFA have published their guides to how CRAs can adapt – without throwing out – their existing models to integrate environmental, social and governance (ESG) credit risks. Hazel … [Read more...]

Renewables “cost of capital” in Europe lower than oil, gas, coal. What the U.S. and China can learn

The ultimate price of anything is highly dependent on the cost of capital needed to put it in place. That cost reflects the risks financial markets perceive. And policy certainty reduces risk. Gireesh Shrimali, Christian Wilson and Xiaoyan Zhou at Oxford University, writing for WEF, summarise their global study which shows the cost of capital for different energy technologies, and therefore which ones will trend upwards and dominate. They cover … [Read more...]

Silicon Valley Bank failed. Don’t blame the Climate Tech it backed

Silicon Valley Bank in the U.S. was a favourite for climate tech start-ups. So its recent collapse inevitably raised questions over whether those start-ups and by extension the whole climate innovation ecosystem was much more fragile than previously thought. Rushad Nanavatty, Colm Quinn and Amy Yanow Fairbanks at RMI explain why that’s not the case. Instead, it was an old-fashioned bank run caused by poor risk management, weakened regulation of … [Read more...]

Wind (and Solar) need their own Financial Transmission Rights to hedge their unique congestion risks

Financial Transmission Rights (FTRs) help generators and load-serving entities hedge congestion-related risk. Transmission congestion causes a divergence between wholesale power prices where it is generated and the trading hubs where it is delivered and sold. Because the congestion, and therefore the risk, varies over time it is particularly important to variable renewables. That uncertainty increases investor risk which potentially slows … [Read more...]

Europe needs a Regional Green Bank to fulfil its Green Deal and match the U.S.

Three years in, the European Green Deal remains unfulfilled as a long-term vision for decarbonising Europe by 2050, says Esmeralda Colombo at EIEE. To inject new momentum, in this week’s speech at the World Economic Forum in Davos, EC President Ursula von der Leyen sketched out a Green Deal Industrial Plan to subsidise the cleantech industry and compete with the rest of the world, notably the US, and the EU Sovereignty Fund to equalise the … [Read more...]

- 1

- 2

- 3

- 4

- Next Page »