Clean energy technologies depend on the reliable and growing supply of critical minerals and metals, far more so than the old fossil fuel world. An EV uses five times the quantity needed by a conventional car, and an onshore wind plant requires eight times that of a gas-fired plant of the same capacity. Hence, electric transport and grid storage are now the largest consumers of lithium and cobalt. Examples of rising consumption abound for other … [Read more...]

Investing for tomorrow, because Energy subsidies will decline 25% by 2050 – analysis

IRENA has modelled energy subsidies to 2030 and 2050 for their pathway to meet the Paris targets. Here, Michael Taylor summarises their findings. Firstly, they estimate today’s global direct energy sector subsidies to be $634bn/year (2017 figures). The vast majority, $447bn, went to fossil fuels. (By the way, he points out that none of these figures include the externality costs - pollution, healthcare, environment - which equate to trillions and … [Read more...]

IRENA’s Global Renewables Outlook and how Europe can lead the way

If the coronavirus slump has knocked everything off track IRENA’s first ever Global Renewables Outlook is a timely reminder of what that track should look like. It can help policymakers design stimuli packages that will get us back onto it, and even accelerate the transition. IRENA’s Gayathri Prakash, Nicholas Wagner and Ricardo Gorini run through the comprehensive report’s main recommendations. Annual investment, shares and GW targets to 2030 … [Read more...]

How Eurobonds can raise trillions for recovery and the Green Deal

EU nations have lined up for and against any form of Eurobonds, including Coronabonds, that would mutualise vast amounts of debt across all the member states. Yet vast amounts are needed to recover from this unexpected and unprecedented global slump caused by the Coronavirus pandemic. Where will it come from? Luca Bonaccorsi at Transport & Environment explains EC president Ursula von der Leyen’s proposal for how the EU budget (on its own, … [Read more...]

EU needs clear European Green and Solidarity Pact by September

Stark predictions around the unprecedented economic challenges facing Europe (and the world) are starting to take shape. The possible solutions must keep pace with them. Here, Marc-Antoine Eyl-Mazzega at the IFRI Centre for Energy & Climate lays out those challenges and robust policy answers that can keep us on a net-zero emissions track while stimulating economies, creating jobs, and maintaining social justice. It’s no surprise that there is … [Read more...]

Designing the Covid-19 stimulus: what the 2008 crisis can teach us

Policy makers around the world are hearing a lot of advice on how to design their stimulus packages. This comes from the IEA where Fatih Birol lays out five fundamental lessons we can learn from the stimulus packages that came out of the 2008 global financial crisis. His main headings are: Build on what you already have – and think big (e.g. feed-in tariffs, production tax credits); Choose technologies that are ready for the big time (e.g. wind, … [Read more...]

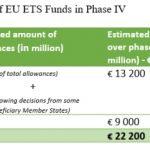

How do we accelerate EU decarbonisation now?

The economic stimulus needed to overcome the current pandemic requires significant resources. But it comes at a time when we need to accelerate the energy transition, which is currently part of the European Green Deal and will also require an increase in resources. Andrei Marcu at ERCST examines how the transition will be funded, what are the sources of funding and how they relate to and will be impacted by the current health situation. A range … [Read more...]

Coronavirus: economic stimulus plans open a door for clean energy

We’re facing an unexpected global economic slump thanks to the coronavirus sweeping across the world. In response, governments everywhere are tabling stimulus packages to get us through what is a temporary but severe drop in economic activity. That stimulus could be used, as it usually is, to get us back on the same path. But it should be used to steer us further and faster onto the new path of clean energy, says Fatih Birol, Executive Director … [Read more...]

Defining green investments, ending greenwash: the EU’s new Taxonomy Regulation

When the EU Commission’s new Taxonomy Regulation is approved, expected in March, it will provide the legal framework to define what is a truly ‘green’ investment. As Luca Bonaccorsi at Transport & Environment explains, right now asset managers and national authorities are free to define what is green, allowing some to greenwash investments in things like oil and pesticides. The Taxonomy's purpose is to reduce ambiguity and therefore increase … [Read more...]

The cost of climate inaction: putting a $ price on 4.5°C warming

Oriana Tannenbaum and Rushad Nanavatty at Rocky Mountain Institute (RMI) have gathered data that puts a price on not making the necessary investments in tackling climate change. For the U.S., a 4.5°C warming scenario (by 2050) will cost $5.2tn. At a more drastic 6°C the cost is $17tn. These projections are hard to do when treating the climate as an “infrastructure asset”, though proven methodologies do exist for tradition assets, and the authors … [Read more...]

$7tn investor BlackRock announces Coal divestment, but not across all funds

BlackRock’s decision to divest from coal, as the world's largest asset manager with a long shareholder history of voting against climate action, sends a powerful signal. By mid-2020 BlackRock’s $1.8tn of actively managed funds will divest from any firm generating more than 25% of revenue from thermal coal. Further reviews of sectors heavily reliant on thermal coal will also take place. Tim Buckley, Tom Sanzillo and Melissa Brown at IEEFA welcome … [Read more...]

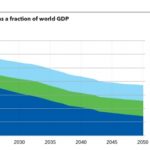

DNV-GL: energy’s shrinking share of growing global GDP shows how we can afford Transition

At the current rate of progress higher energy efficiency, more renewables, and carbon capture will not be enough to keep the global temperature rise to well below 2°C. So to point the way, DNV-GL has condensed its Energy Transition Outlook 2019 into 10 ways technology can meet the COP21 targets. This article gives figures on how much solar and wind we really need, battery production, annual investment in grids, and energy efficiency. It further … [Read more...]

Non-energy firms lead investments in clean energy start-ups

Investments in innovative “blue sky” companies tell us where the bets are being placed on the energy sector’s future. Such investments leaped in 2016, mostly directed at clean energy technology. This analysis by Simon Bennett at the IEA usefully includes a long list of firms and their investments. Digital sensors, batteries, electric vehicles and smart algorithms are among the main recipients this year. Other fascinating categories include … [Read more...]

Private finance must invest in carbon asset retirement, not just clean energy

The Climate Finance Leadership Initiative (CFLI) is laying out concrete plans for the private sector to finance the low-carbon transition, say Tyeler Matsuo and Lucy Kessler of Rocky Mountain Institute. One important insight of their new report “Financing the Low-Carbon Future” is that it’s not enough to back clean energy. Climate finance also needs to accelerate the retirement and transformation of the carbon assets that are responsible for 78% … [Read more...]

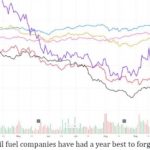

IEA: Big energy firms cannot ignore the Transition

Alessandro Blasi and Alberto Toril of the IEA look at how oil and gas majors are still investing very little - of the order of a single percentage point - in clean energy projects. What they are doing in response to new anti-fossil climate policies is increasing investment in short cycle projects that generate cash and returns quickly, minimising risk. This is a questionable strategy, given the fundamental shift away from thermal power and fossil … [Read more...]