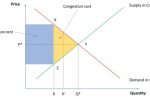

Interconnectors allow for cross-border flows of energy between two markets that would otherwise not be connected. Through an economic convergence between supply and demand, the cheapest marginal producer located anywhere in these two markets should be able to set market prices. As Jean-Baptiste Vaujour at the Emlyon Business School explains, the central question is to find an optimal allocation of the scarce interconnection capacity between the … [Read more...]

Financing Europe’s cross-border Interconnectors to deliver energy security, lower prices: a look at incentives and policies

The EU and its Member States are building out interconnectors to improve security of supply and affordability of electricity through the physical and economic linking of national energy markets into a single, synchronised European market. But each interconnector is expensive, complex and therefore risky. They can span long distances or natural obstacles such as mountains or seas. Significant network planning and adaptation is needed to account … [Read more...]

EU Energy Outlook to 2060: power prices and revenues predicted for wind, solar, gas, hydrogen + more

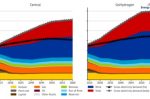

Huangluolun Zhou, Elena Dahlem and Alex Schmitt at Energy Brainpool present their updated “EU Energy Outlook 2060”, modelling how the European energy system will undergo major changes in the coming decades while continuing to guarantee a secure supply and meet its climate targets. What do these developments mean for power prices, revenue potential and risks for solar PV and wind? The two main scenarios are “Central” and “GoHydrogen” for the EU 27 … [Read more...]

EU states agree deal on electricity market to protect consumers from price volatility, boost cheap renewable power

On Tuesday EU member states finally agreed on how to reform the bloc's electricity market after long months of difficult negotiations. The introduction of long-term contracts, particularly contracts for difference (CfDs), should stabilise prices for consumers and give certainty to investors in new generation. But the big concern had been how the state support implicit in CfDs might be used to bias the playing field in favour of nuclear and coal, … [Read more...]

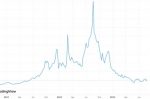

Can we expect Gas price volatility and spikes this winter? Why?

Europe has done well in pivoting away from Russian gas imports. After painful energy prices rises in 2022 they have fallen steadily this year. LNG imports and the infrastructure to support them is growing. And Europe’s gas storage levels hit 90% capacity three months ahead of the November target. But the challenge is far from over, explains Michael Bradshaw at Warwick Business School. European gas prices remain 50% above their pre-invasion … [Read more...]

EU Energy Outlook to 2060: how will power prices and revenues develop for wind, solar, gas, hydrogen + more

Alex Schmitt and Huangluolun Zhou at Energy Brainpool present a summary of their “EU Energy Outlook 2060”. Its scenarios map out how the European (EU 27, UK, Switzerland and Norway) energy system will change dramatically in the coming decades. Current geopolitical tensions are added to climate mitigation and an outdated power plant fleet as the main drivers of change at the EU and national levels. The in-depth modelling is trying to answer the … [Read more...]

“Options to Reform the EU ETS”: coping with price volatility and speculation (event summary)

Sara Stefanini provides a written summary of our panel discussion held on 31st March 2022, “Options to Reform the EU ETS”. It’s a full summary of the 90 minute discussion (with a link to the video), but it begins conveniently with a summary of the highlights, leading with the role of financial players, who they are, the causes of price volatility, what reforms can create stability, and the cost of decarbonisation. The main concern is speculation … [Read more...]

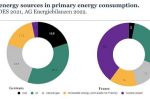

Gas Crunch: time to factor in volatility and externalities to reveal its true costs

The current gas price shock (and any future ones) raises the question: if we had invested more in renewables, efficiency, buildings renovation, and green gases, would we be actually saving money instead of losing it? Looking at the EU, Dolf Gielen, Michael Taylor and Barbara Jinks at IRENA urge governments to do something they’ve not done before and factor in the negative impacts of volatile fossil fuel prices. Moreover, they should calculate the … [Read more...]