The oil and gas producers have made windfalls off the back of Russia’s invasion of Ukraine and the consequent spikes in prices. But the return of prices to normal levels is re-emphasising the flaw in their business model, explains Clark Williams-Derry at IEEFA. The cost of producing the fossil fuels can only go up: the low hanging fruit was picked long ago, and finding and extracting new deposits gets more and more expensive. So do labour costs. … [Read more...]

How new and better science is driving climate litigation

Delta Merner at the Union of Concerned Scientists makes her predictions for climate litigation in 2023. There will be much more, globally. The stand out observation is that new and better science is driving the evidence, impacting the litigants and the courts. That points at major changes to the litigation landscape. More granular geographical evidence allows local litigants to more accurately make a case for connecting emissions and pollutants … [Read more...]

Corporate greenwashing: will court cases and new rules close the gap between promises and reality?

Activists are taking firms to court over deceiving consumers with questionable climate pledges. Isabel Sutton at Clean Energy Wire summarises the issues. Greenwashing, and therefore misdirecting consumer behaviour, is clearly a barrier to achieving climate goals. The latest IPCC report says consumer behaviour and changes to our lifestyles can result in a 40%–70% reduction in greenhouse gas emissions by 2050. But unregulated advertising can say … [Read more...]

Veracity of corporate net-zero pledges and advertising is being challenged in court

Clean Energy Wire (CLEW) is putting the spotlight on corporate climate pledges, the advertising they use to win customers, and their claims of reducing their emissions. Here, Isabel Sutton at CLEW summarises the major landmark legal cases in multiple countries being brought against corporates by activists and other claimants. Companies under scrutiny include TotalEnergies, KLM, Drax, Shell, BP, Beiersdorf (personal care products), and more. … [Read more...]

Event Summary: “CHINA: Carbon Neutral by 2060 – Innovation”

Here are the highlights of our 2-day 4-session workshop “CHINA: Carbon Neutral by 2060 - Innovation”, compiled by Sara Stefanini. It’s a quick and efficient way for readers to see the main points made by our expert panellists. Held at the end of May, it was the fourth of our EU-China workshops since the first was held in November 2020, produced for the EU China Energy Cooperation Platform (ECECP). As always, leading speakers from the EU, major … [Read more...]

The Green Hydrogen disruption: what nations, firms and investors are doing to reshape global energy

Everyone knows the new hydrogen economy has huge up front capital costs to make the green H2 (called GH2), the logistical challenges of delivering it where it’s needed, and creating the customer base to consume it. But Tim Buckley at IEEFA believes the policy support is already shaping up to make GH2 a successful disruptor of the global energy system. He runs through the nations, companies and investors at the beginning of the learning curve that … [Read more...]

New U.S. Offshore Wind target: from standing start to 30GW by 2030

In March, the Biden administration announced a bold target to deploy 30GW of offshore wind capacity by 2030. Until now, offshore wind’s rise has been driven almost exclusively by Europe and China. The U.S. accounts for just 0.1% of the world’s installed capacity (versus 17% for onshore wind). Why the hold up, given the U.S. could require up to 400GW of offshore wind by 2050? As Stephen Naimoli and Nikos Tsafos at CSIS explain, offshore costs … [Read more...]

Norway’s “Northern Lights” project: creating the CCS business model

Northern Lights, a carbon capture and storage (CCS) project backed by the Norwegian government, is drilling test wells in the North Sea to find suitable places to store CO2. Project partners include Shell and Total, and others are joining them. CO2 will be shipped to an onshore terminal from which it is piped to the subsea wells. Once established, the plan is for other European countries to send their CO2 too. The project will also create the … [Read more...]

Fossil fuel politics is changing: Big Oil, automakers split on Trump lowering standards

Cara Daggett at Virginia Tech has noticed a positive change in corporate support for the Transition. In the past, Big Oil and automakers would have opposed any limits to business-as-usual. But today, major oil companies, including BP and Royal Dutch Shell, are opposing U.S. President Trump’s intention to further deregulate methane emissions. That’s because they’ve invested heavily in natural gas as a bridge fuel for a clean future, which would … [Read more...]

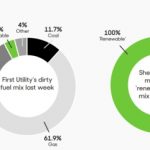

“Stop trading renewable energy supply certificates, speed up the transition”

In the UK, REGOs certify that the power a consumer buys is renewable. As REGOs can be traded that means one supplier, sourcing 100% of their energy from renewables, and another simply buying enough REGOs to cover 100% of their output can both say they are 100% renewable. Is there a difference? Yes, says Thomas Harrison at supplier Good Energy. Trading REGOs takes the pressure off suppliers to use all their buying power to expand the supply of … [Read more...]

East Mediterranean gas finds: EU energy bonanza or geopolitical headache?

Some of the world’s largest natural gas reserves have been discovered off Cyprus. One of the questions being addressed at this year's CERA Week is, could these massive finds (totalling more than 70 trillion cubic feet!) be the answer to any perceived over-dependency on Russian gas imports to the EU? Maybe, maybe not. Geopolitical tussles could scupper the realisation of these much-needed resources for Europe. Whilst the potential is there, it may … [Read more...]

Virtual power plants: a story of market rules and smartgrids

Access to the grid-balancing market is competitive and carefully regulated. Green electricity from distributed and behind-the-meter renewable assets is already being traded on wholesale and balancing markets. The assets come in all shapes and sizes: roof-top solar, farmyard biofuel installations, EV and home battery systems, community energy projects, wind installations and heat pumps to name but a few. When they are pooled, by aggregators, they … [Read more...]

Green Oil: second wave of investment in low-carbon assets is substantial but hardly tidal

Oil majors are under significant pressure from investors to develop climate-friendly business areas but less than 1.5% of their combined investment budgets is expected to go into low-carbon assets globally this year. However, 70% of that is set to come from European oil companies who are reacting positively to market signals by participating in coordinated industry schemes designed to help meet Paris targets. Here is an overview of some of the … [Read more...]

Analysis: BP’s outlook for fossil fuels could be undermined by slowing energy demand

BP’s latest projections, released last week, once again concede that their previous reports have been overestimating fossil fuel consumption and underestimating renewables. Yet BP still predicts total energy demand will grow indefinitely thanks to overall global growth, and fossil fuels will always be needed. But Simon Evans at Carbon Brief shows how these projections contrast starkly with McKinsey’s, who find that the efficiency of renewables … [Read more...]

Energy majors grab blockchain “multi, multi-billion dollar opportunity”

Blockchain is being used to optimise performance across the board where wholesale digitalisation of trading processes, asset management and demand response is standard. Its adoption by sector operators is clearly visible but is everyone jumping on an untested bandwagon for fear of missing out or will its wide range of possible applications help deliver a leaner industry resulting in reduced costs and a more efficient transition? Gaurav Sharma … [Read more...]