What are the sources of investment and sources of finance in the energy sector? Cecilia Tam, Paul Grimal, Jeanne-Marie Hays and Haneul Kim at the IEA summarise insights extracted from the IEA’s latest flagship World Energy Investment report which this year has dug much deeper into the subject. They look at the capital structure (debt versus equity) of energy investments in assets and companies. They look at the entities making the investments, … [Read more...]

UCO (Used Cooking Oil) for biofuels: how much is fraudulently imported virgin vegetable oil?

UCO (Used Cooking Oil) is a feedstock for biofuels. In 2023, European countries consumed close to seven million tonnes of UCO for biofuels. This is four times the continent’s maximum potential for supplying it domestically, so the rest comes from imports, mostly from China, Malaysia and Indonesia. The vast majority is blended for biodiesel to use in cars and trucks. UCO accounted for one third of conventional biodiesel feedstocks and a quarter of … [Read more...]

Superconducting overhead Transmission Lines that deliver 400MW (and targeting several GW)

How do you double or triple your existing power transmission capacity when costs are rising and you face local opposition to the disruption? Zach Winn at MIT describes a new innovation that uses superconductors designed to transport five to 10 times the amount of power of conventional transmission lines, using essentially the same footprint and voltage level, carried on otherwise standard overhead lines. The superconducting cables (with much of … [Read more...]

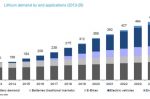

Private sector must jump start Lithium-ion Battery Recycling, as first wave of EVs now near end of life

The recycling of lithium-ion batteries is vitally important to the future of electric power, explains Gregg Smith at Orbia Advance, writing for WEF. Making a battery has a significant carbon footprint of its own. Yet recycling can be one tenth the cost of manufacturing a battery from scratch. And energy security is enhanced by lessening dependence on mining countries and other suppliers. It’s why Europe will require new batteries to contain at … [Read more...]

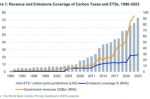

Carbon Pricing annual receipts are almost $100bn globally and rising

About one-quarter of global emissions are, to varying degrees, covered by carbon pricing schemes. They’ve raised over $500bn from polluters to date. Andrew Reid at NorthStone Advisers, writing for IEEFA, summarises his report which says the annual amount raised, now almost $100bn, is set to increase with two-thirds of nations planning to use carbon pricing in their Nationally Defined Contributions. And the EU’s Carbon Border Adjustment Mechanism … [Read more...]

The Fossil Fuel system wastes 2/3rds of its energy before it gets to you. Inefficiency is driving it out (not just emissions)

Today’s fossil energy system is very inefficient: almost two-thirds of all primary energy is wasted in energy production, transportation, and use, before fossil fuel has done any work or produced any benefit. That’s almost 400 EJ wasted, worth over $4.5tn, or almost 5% of global GDP. Two activities - fossil fuel power plants and internal combustion engines - are responsible for almost half the energy waste globally. Daan Walter, Kingsmill Bond, … [Read more...]

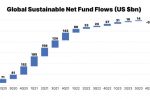

ESG investing: a look at actual performance, constraints, fund flows, regional differences

Inflows into ESG (environmental, social, and governance) funds remain strong, especially in Europe. That’s despite high interest rates and the boost to oil and gas from Russia’s invasion of Ukraine. According to a new report by Ramnath Iyer at IEEFA, in 2023 the performance of ESG funds and exchange-traded funds (ETFs) matched or surpassed that of traditional funds and ETFs. Morningstar figures reveal that sustainable funds had a median return of … [Read more...]

Forecasting the performance of new Solar PV module technologies over 20, 30, and 50 years

Solar PV technology continues to innovate and evolve at a rapid pace. Testing the modules is essential for predicting durability and future performance. But that inevitably means past experience is not a good predictor of the behaviour of the new materials and configurations. Sara Fall and Harrison Dreves at NREL explain how the Durable Module Materials (DuraMAT) Consortium has set up sophisticated testing and data gathering to use the … [Read more...]

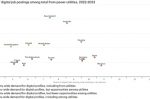

Digitalisation of the Energy sector: are Utilities hiring the skilled workers they now need?

Like many other sectors, the energy sector needs employees with digital skills. They need to create the new tools that can match power supply with demand, predict and detect faults in networks, and give greater control to consumers. It’s an essential part of the new world of decarbonisation, with digitalisation enabling the faster integration of renewables, improving grid stability and unlocking greater energy savings. Aloys Nghiem, Marc … [Read more...]

The EU’s Carbon Border Adjustment Mechanism still has 5 serious flaws

Taxing carbon at the border is a lot more complicated than you may think, explains James Bushnell at the Energy Institute at Haas. The EU’s Carbon Border Adjustment Mechanism (CBAM) imposes a tax on imported goods that is designed to reflect the carbon content of those goods. But CBAM has flaws that must be addressed. It taxes the carbon in imported inputs supplied to EU producers, but not the carbon of those same inputs if they are imported as … [Read more...]

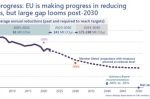

June deadline for EU nations’ NECPs: will this year’s plans show they’re taking the climate seriously?

On June 30th, EU Member States have to submit the final revision of their updated National Energy and Climate Plans (NECPs) to the European Commission. NECPs specify their climate and energy targets and trajectories up to 2030, with an outlook to 2040 and the longer term. NECPs must also feature the policies and measures planned to achieve these targets, as well as their funding needs and sources. But, as Federico Mascolo at CAN Europe explains, … [Read more...]

Swappable EV batteries are on the rise in China and India. Why not the West?

Western governments are struggling to meet their targets for zero-emission vehicles, says ManMohan Sodhi at City University of London. There’s been a slowdown of sales that has a lot to do with the high cost of new EVs and the lack of charging infrastructure. Meanwhile, in China and India battery swapping – instead of charging your own battery – is on the rise. Swapping can take minutes. Knowing you can swap means you don’t need a big battery for … [Read more...]

New “Solar Thermal Trapping” process can generate 1,000°C for steel, aluminium and cement production

Many industries – production of steel, aluminium and cement being the most obvious – require high heat processes that today can only be achieved commercially using fossil fuels. Paige Bennett at EcoWatch, writing for WEF, describes a new process using solar thermal trapping to reach temperatures of a little over 1,000°C, hot enough to smelt metal. Scientists used semi-transparent materials, including synthetic quartz, to capture sunlight that … [Read more...]

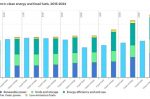

At $2tn, investment in Clean Energy in 2024 is set to be double that for Fossil Fuels

A new report by the IEA reveals that global spending on clean energy technologies and infrastructure is on track to hit $2tn in 2024, driven largely by attractive cost reductions, improving supply chains, energy security, and government policies. This is despite higher financing costs for new projects. The combined investment in renewable power and grids only recently overtook the amount spent on fossil fuels, in 2023. 2024 will see it at double … [Read more...]

Tariffs on China’s carmakers? Chinese joint ventures and on-shoring would be better

Both the U.S. and the EU are targeting China’s carmakers with tariffs. China is accused of providing state support that allows exported vehicles to be sold at cheaper prices than those of global rivals. The tariffs will allow U.S. and EU carmakers to build up their own domestic supply chains and catch up in competitiveness. But cheap EVs help accelerate the clean transition, so tariffs will only slow it down, certainly in the short term. And … [Read more...]