The EC has put forward proposals for tightening the implementation of a price cap on Russian oil exports. Brian O’Toole, Olga Khakova and Charles Lichfield at the Atlantic Council and Tomasz Wlostowski at EU Strategies review the performance of the price cap sanctions one year on from their implementation, and give recommendations for how to make them work better. Though most observers agree that the cap has limited export income for Russia this … [Read more...]

When 0.2% Methane leakage can make Gas dirtier than Coal

Around the world gas is replacing coal to reduce emissions. But even small amounts of methane leakage in the gas life-cycle can make emissions on par with or even worse than coal, explain Shannon Hughes and Deborah Gordon at RMI. They present their calculator that shows if West Virginia state's gas methane leakage rate is just 1.4% their emissions equal the coal it replaces. Texas Permian LNG exported to China only needs a leakage rate of 0.2% to … [Read more...]

Oil & Gas business is fatally flawed: Russia-Ukraine only delayed the relentless decline in prices

The oil and gas producers have made windfalls off the back of Russia’s invasion of Ukraine and the consequent spikes in prices. But the return of prices to normal levels is re-emphasising the flaw in their business model, explains Clark Williams-Derry at IEEFA. The cost of producing the fossil fuels can only go up: the low hanging fruit was picked long ago, and finding and extracting new deposits gets more and more expensive. So do labour costs. … [Read more...]

Can we expect Gas price volatility and spikes this winter? Why?

Europe has done well in pivoting away from Russian gas imports. After painful energy prices rises in 2022 they have fallen steadily this year. LNG imports and the infrastructure to support them is growing. And Europe’s gas storage levels hit 90% capacity three months ahead of the November target. But the challenge is far from over, explains Michael Bradshaw at Warwick Business School. European gas prices remain 50% above their pre-invasion … [Read more...]

Russia’s oil export revenue rebounded in March–April. Why aren’t the EU, U.S. and partners enforcing the price cap?

The Price Cap Coalition (PCC) - composed of Australia, Canada, the EU, Japan, the UK, and the U.S. – are failing to either enforce or lower the cap on Russian oil exports as promised, says a report summarised here from the Centre for Research in Energy and Clean Air (CREA). Had it done so, Russian revenues could have been slashed by €22bn (37%) since December by lowering the price cap for crude oil to $30/barrel and revising the caps for oil … [Read more...]

Will U.S. become the Global Gas Market’s source of flexibility and security of supply?

The U.S. will take the lead in offering flexibility and security of supply to the global gas market, and at prices linked to its wholesale gas market, the most liquid in the world, argue Kong Chyong and Ira Joseph at the Center on Global Energy Policy. It’s because the U.S. leads in the three key sources of gas trade flexibility, critical to meeting unexpected supply and demand gaps: natural gas storage systems, spare capacity in production and … [Read more...]

Nearly half of national climate pledges (NDCs) intend to keep extracting fossil fuels

“Nationally Determined Contributions” (NDCs) are a nation’s published plans to reduce emissions and adapt to the impacts of climate change. Natalie Jones at the IISD, writing for Carbon Brief, summarises her co-authored study that reviews the fossil fuel production element of those NDCs. Nations are obliged to update their NDCs every five years, to give more detail. That added detail is a cause for concern in the latest round of NDCs: there is an … [Read more...]

Evidence of a direct link between Wildfires and Fossil Fuel firms. Can it be used to sue them?

Wildfires are back in the news. The link to rising global temperatures caused by climate change is clear. Mark Specht at the Union of Concerned Scientists summarises their study that, for the first time, puts a number on the level of responsibility attributable to fossil fuel companies. Rising temperatures create a “vapour pressure deficit,” a measure of the power of the air to dry out plants and trees. That leads to an increase in the area … [Read more...]

U.S. EPA: new rules proposed for cutting Fossil Fuel-Fired Power Plant emissions

In May the U.S. Environmental Protection Agency proposed new rules regulating carbon emissions from fossil fuel-fired power plants. Here, four experts from the Center for Strategic and International Studies – Cy McGeady, John Larsen, Kyle Danish and Mathias Zacarias – make their assessment and point at the wide-ranging implications. The main issues covered include CCS, hydrogen-fuelled generation, state clean energy standards, carbon pricing, … [Read more...]

The history of evidence of CO2-driven climate change starts in the mid-1800s

Marc Hudson at the University of Sussex gives us a fascinating review of the history of climate change science. While the Intergovernmental Panel on Climate Change (IPCC) was established in 1988, experimental evidence that CO2 traps heat dates back to the mid-1800s. The first predictions of global warming caused by humans came in 1895. The big change in perception took place in 1953. Canadian physicist Gilbert Plass (an academic whose career also … [Read more...]

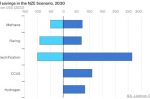

Oil & Gas can meet 2030 net-zero target for only $600bn, quickly recouped. But it’s still not happening, warns IEA

The IEA summarises its 33-page report “Emissions from Oil and Gas Operations in Net Zero Transitions”. The IEA says the oil and gas sector needs £600bn up front to meet its 2030 target of a 60% reduction in emissions. That’s only 15% of the sector’s record 2022 energy-crisis windfall income. A small price increase and savings should recoup that money “quickly”, says the IEA. The IEA not only maps a way to limit the global average temperature rise … [Read more...]

Europe: preventing a “carbon wall” between the West and the ten Central and Eastern EU nations

Diana-Paula Gherasim at the IFRI Centre for Energy & Climate summarises her 36-page data-rich report on the progress and challenges for the ten Central and Eastern EU (CEECs) countries in decarbonisation. The Russian invasion of Ukraine has focussed all minds on energy security and the best solutions: less fossils, efficiency gains and clean energy made in the EU. Gherasim says that vitally important progress is being made in avoiding a … [Read more...]

Falling oil prices are defying the forecasters. Expect to be surprised for the rest of the year

The worst expectations for oil prices never materialised, thank goodness. In mid-March a year ago Brent reached $114 and WTI $103 a barrel. By the same time this year it was $72 and $66 respectively. That’s despite no end in sight for the Russia-Ukraine war, the trigger to the 2022 price escalation and global crisis. Carole Nakhle at the University of Surrey explains how today’s forecasts are similarly uncertain. She points at conflicting … [Read more...]

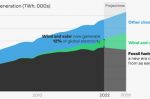

Record clean-power growth in 2023: is Coal and Gas decline now structurally embedded?

Last year, wind and solar reached a record 12% of global electricity generation, according to think tank Ember’s latest global electricity review. The overall share of all forms of low-carbon electricity rose to almost 40% of total generation. Josh Gabbatiss at Carbon Brief goes through the Ember review which heralds this as the moment fossils began their permanent decline. Ember calls it “structural” and “enduring” because previous declines only … [Read more...]

The U.S. is moving faster than the EU on Methane regulations. Why?

Ben Cahill at the Center for Strategic and International Studies takes a deep dive into U.S. and EU progress on regulating methane emissions. It’s vitally important because methane has more than 80 times the warming potential of CO2 in its first 20 years in the atmosphere. In his assessment, Cahill explains why the U.S. is likely to move much faster than the EU. Unlike the U.S., the EU is a big importer of gas so needs its rules complied with by … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 54

- Next Page »